Q1 2025 Market Commentary

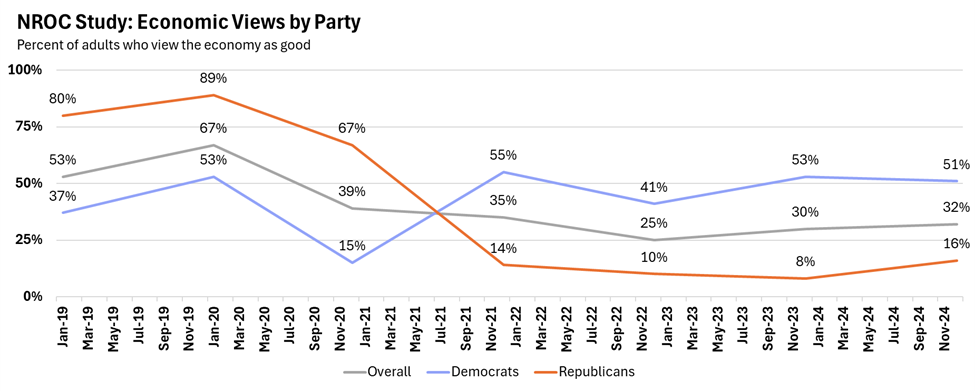

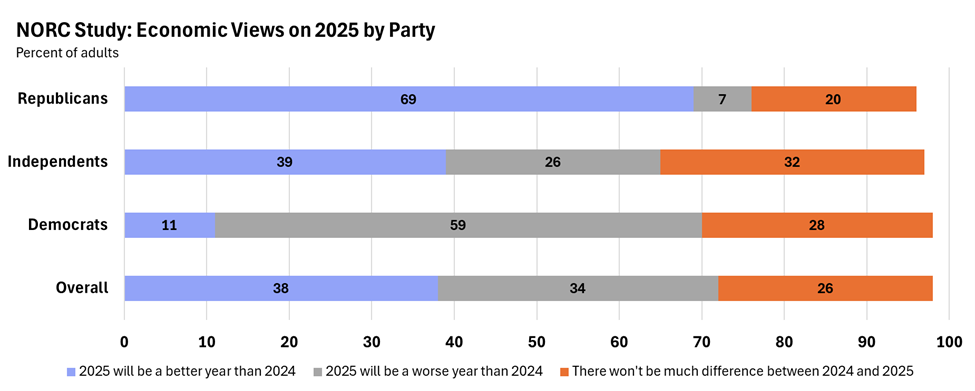

The 2020s started with a global pandemic, ushering in an era of unprecedented uncertainty. Investors have witnessed dramatic market fluctuations in stocks and bonds, two contentious U.S. elections, and two international conflicts. A recent National Opinion Research Center (NORC) study reveals a stark partisan divide in economic outlook: while overall views have been negative in recent years, Republicans have expressed significantly more pessimism than Democrats1. Looking ahead to 2025, this divide persists, but with 69% of Republicans anticipating economic improvement compared to 11% of Democrats. Economic perceptions also vary by income, with 41% of adults earning over $100,000 viewing the economy positively versus just 25% of those earning under $50,000.

While the pervasive uncertainty remains undeniable, the truth usually lies somewhere between extremes. Real time measures suggest economic growth of approximately 2.5% to 3%2 and business confidence has surged post-election3. Proposed policies from the Trump administration may have offsetting effects on the economy. Immigration and tariff policy could pose challenges to progress on inflation, while renewed business optimism and tax cuts will likely be stimulative. As the Federal Reserve was raising interest rates to combat price changes, a robust labor market likely mitigated the impact of higher borrowing costs, and employees found it easy to find new work while demanding higher wages. Today, we are seeing early signs of loosening in hiring, although large scale layoffs have not materialized. Given this balance, we anticipate continued bifurcation across income levels, industries, and geographies. The economic outlook remains incredibly mixed, and it is difficult to have a strong conviction on the overall direction (i.e. hard landing, soft landing, etc.). Below, we focus on where our team does have convictions.

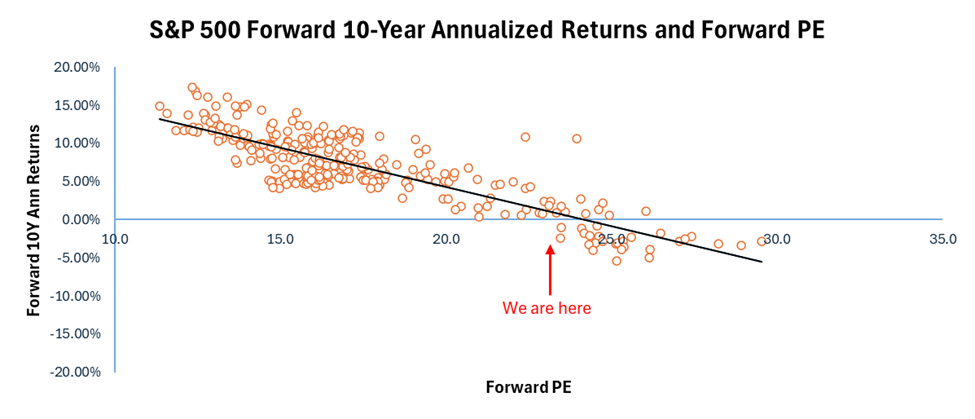

Conviction 1: Opportunities Exist Beneath the Surface and Outside of U.S. Large-cap Stocks. The two factors which move stock prices are earnings (or earnings expectations) and valuations. Since 2022, the S&P 500 Index has returned 58.7% before accounting for dividends (The S&P 500 Index is a popular market-cap-weighted benchmark for large-cap U.S. stocks where companies with a higher market cap have a larger weight). The valuation multiple investors are willing to pay for the same basket of stocks has risen 45.5% – meaning valuation expansion has contributed to 77.9% of the large-cap U.S. stock market return. The other 22.1% is attributed to higher earnings expectations. As a result, the U.S. large-cap stock market is trading at a 16% premium to its 10-year average valuation, and a 33% premium to its 20-year average valuation. Coincidentally, we find valuations on U.S. large-cap stocks have a large determining factor in forward returns over the following ten years.

Many would point to an expensive stock market today as a reason to believe forward returns will be lower. However, we find pockets of opportunity exist below the surface and outside of the U.S. Large-Cap stock market. Consider the following: while the market-cap-weighted index for U.S. large-cap stocks is historically expensive, the equal-weighted index trades at a discount to its 10-year average valuation and in line with its 20-year average valuation. In our opinion, market concentration (which we have discussed in the past) in a handful of stocks has caused the U.S. stock market to appear expensive. The last time the U.S. Large-Cap stock market was this expensive with this much concentration, the equal-weighted index outperformed by an annualized 4.35% (49% total) over the next ten years. At the same time, small and mid-Cap stocks, as well as International Developed and Emerging stocks, are trading below their long-term valuations. Periods of expensive valuations and market concentration in the past have preceded weaker forward broad market returns, but we find that these periods are the best times to hunt for bargains.

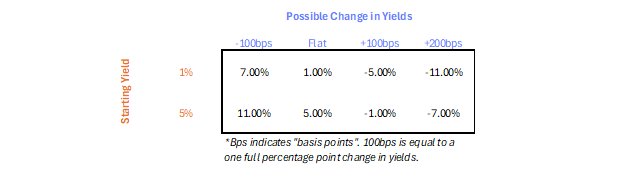

Conviction 2: Bonds Once Again Offer Attractive Diversification Benefits. 2022 provided a key test for the belief in bonds as a diversification tool in portfolios. From 1980 to 2020, bond yields moved lower. After the Federal Reserve cut rates during Covid, the aggregate U.S. bond market was yielding around 1% with an average maturity of around eight years (this would be like buying an 8-year bond with a 1% yield to maturity). As the global economy recovered, inflation moved higher, and central banks raised short-term rates, bond yields moved higher; the aggregate U.S. bond market yield moved from 1% to over 5% by the end of 2022. As a quick refresher on bond math, bond prices and yields work inversely – as bond yields move up, bond prices move down, and the change in price is a factor of the duration on a bond investment. (Duration is a measure of interest rate risk.) As a result, the U.S. aggregate bond market returned -14.4% from 2020 to 2022 (annualized return of -7.5%). Suddenly, the asset class many investors had relied upon for diversification from equity market volatility was called into question.

Our opinion is bonds will prove to be a better diversification and wealth preservation tool moving forward. The aggregate U.S. bond market now yields close to 5%, giving investors a much greater risk/reward profile in the face of interest rate uncertainty, as well as higher income in the face of stock market volatility. A higher starting yield on a bond provides downside protection to rising interest rates through the form of higher income. The ultra-low starting yield on the aggregate U.S. bond universe at the beginning of 2021 provided little to no buffer to a move from 1% to 5% over a two-year period. Demonstrated below, a move higher in yields from this point would be buffered by the higher starting yield. Within bond allocations, we are remaining short duration – which means we are taking less interest rate risk than we typically do over long periods of time. While we find current yields across the bond market fair, we find there is too much uncertainty around the direction of interest rates to take a long duration position.

Conviction 3: Optimism Pays Amidst Uncertainty. While it is easy to get bogged down in the daily dose of negative headlines, we are often reminded that the world moves in cycles, and not just financial markets. Periods of uncertainty and volatility often precede periods of optimism and extreme societal advancement. While many worry about the rapid advancement in Artificial Intelligence, AI technologies are already enhancing the prevision of radiotherapy by improving tumor boundary delineation, treatment planning optimization, and enabling real-time adjustment. This new technology is leading to better therapeutic outcomes while minimizing the damage to healthy tissues4. The Mayo Clinic has also developed a hypothesis-driven AI model that analyzes complex data to improve cancer diagnosis5.

While the war between Russia and Ukraine continues, there is a temporary cease fire in Gaza. In our opinion the post-Covid world has thus far felt volatile, but we are also reminded of the good in the world. While we are always incredibly focused on risk in client portfolios, we also think it pays to be optimistic over the long term.

Sources:

- https://apnorc.org/projects/negativity-about-the-national-economy-persists-but-republicans-are-optimistic-about-improvements-in-2025/

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.nfib.com/news-article/monthly_report/sbet/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC10697339/

- https://www.labiotech.eu/in-depth/ai-oncology/

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. The information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involve risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.