Acumen’s Current Market Introspective

Last December, Acumen celebrated its tenth anniversary with a great festive evening. We reflected on how grateful we are to have such remarkable clients. As we closed out 2021, we were celebrating a great year of market performance. All the liquidity was pumped into the system after COVID causing asset prices to increase at a feverish pace. However, just as our party was ending last December, the growth in the market was also ending abruptly.

We could have been purchasing any asset in client accounts. It pays to be reserved. Fortunately, we took a conservative stance within our client accounts. We did not get swept up in Bitcoin (down 56.49% YTD as of 10/25) and we started positioning portfolios more conservatively.

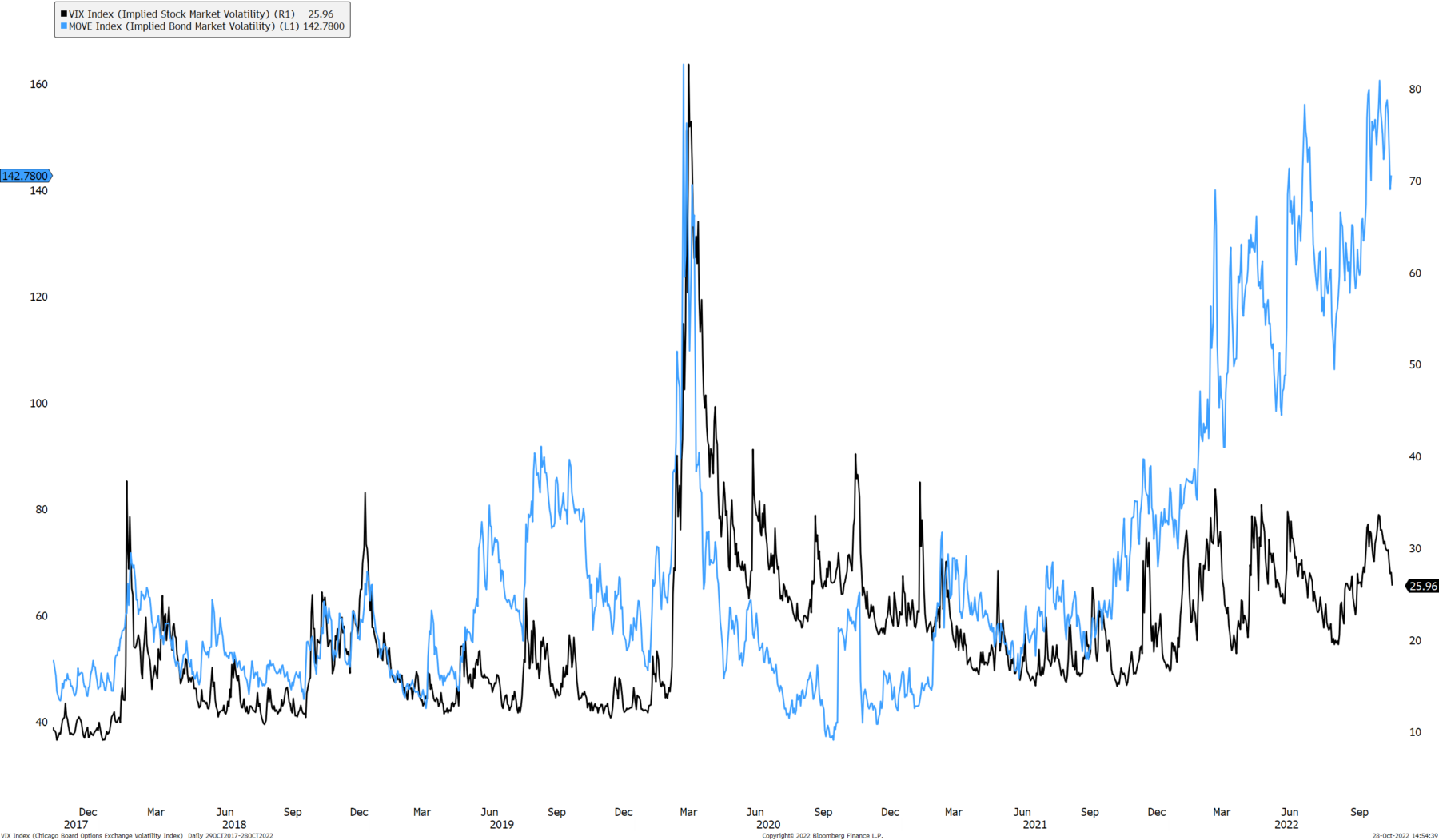

That said, client portfolios are still down this year. It would be hard not to be this year. So far, it has proven to be one of the most difficult times for investors with most major asset classes having displayed a heightened level of volatility year to date (Figure 1). Major stock market indexes are down more than 20%, and even the bond market, which is typically looked at as a more defensive asset class, is down more than 15% on the year. Areas more sensitive to interest rates have gotten hit harder, while more defensive areas have performed better.

The best performing asset classes throughout the year have been those tied to the inflation trade, such as energy stocks and commodities. However, we would point out the performance of those trades depends on the timing. Through the first five months of 2022, energy stocks were up around 60%, and a broad basket of commodities returned a little more than 30%. Since then, energy stocks have declined 10% and commodities are down 18%, both underperforming the broad stock market.

What are the main contributors to the volatility in financial markets?

We believe the primary reason for the volatility this year is the large pivot from monetary authorities to a restrictive monetary policy. It is now clear global central banks were behind the curve in tackling inflation tailwinds. In the U.S., the Federal Reserve stayed largely adamant about focusing on headline inflation numbers and the labor market. However, both are backward looking measures with lagged effects.

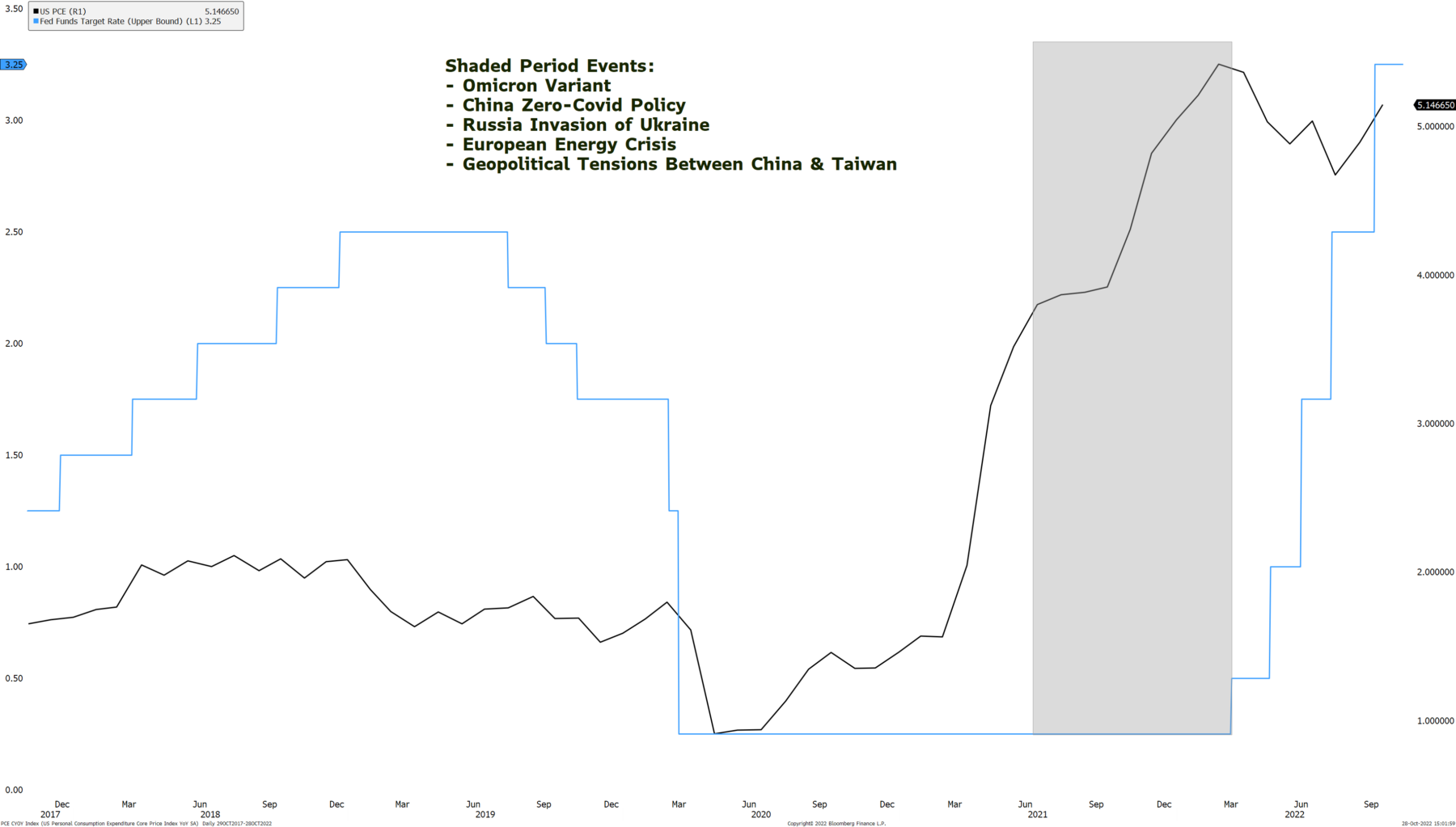

The second half of 2021 and first quarter of 2022 produced the Omicron variant of Covid-19, a European energy crisis, continued China zero-Covid policy, Russia’s invasion of Ukraine, and geopolitical tensions between China and Taiwan. We believe all these factors pushed the inflation tailwinds even harder and met head on with a monetary policy environment that was still in expansion mode at the start of 2022 with short-term interest rates still close to 0% (Figure 2). Essentially, we view this as a perfect storm of supply disruptions meeting very strong demand from consumers.

Now, monetary policy is having to catch up through a dramatic rise in interest rates, which increases the cost of capital and borrowing, and slows the economy down as a whole. While higher interest rates do not always equate to downside in financial assets, we see the size and pace of the pivot to a restrictive monetary policy framework as being the main contributor to volatility this year.

Will we see a recession?

Throughout the year, we have become more convicted the global economy would enter a recession at some point in 2023. While many were focused on the potential of a “soft landing” for the first half of the year, we found leading economic indicators pointed to lower global growth. Depending on where you look, most indicators have the probability of a recession in the next 12 to18 months for the U.S. at anywhere from 50% to100%, and our belief would likely fall into the higher end of this range. The outlook for international economies is a little bit bleaker, with a higher percentage chance of a recession in Europe, the UK, and China who is likely already in a recessionary environment.

What is our outlook for monetary policy and inflation?

This outlook is likely the toughest question investors face today and is especially important for portfolio construction. The U.S. Federal Reserve has been transparent in their plan to continue raising short-term interest rates to a level closer to 4.5% and leave these rates in place for a sustained period. Alongside continued interest rate hikes, they are implementing the process of Quantitative Tightening (QT), where they allow financial assets to roll off their balance sheet – another restrictive monetary policy tool. These actions are geared to fight the current high levels of inflation.

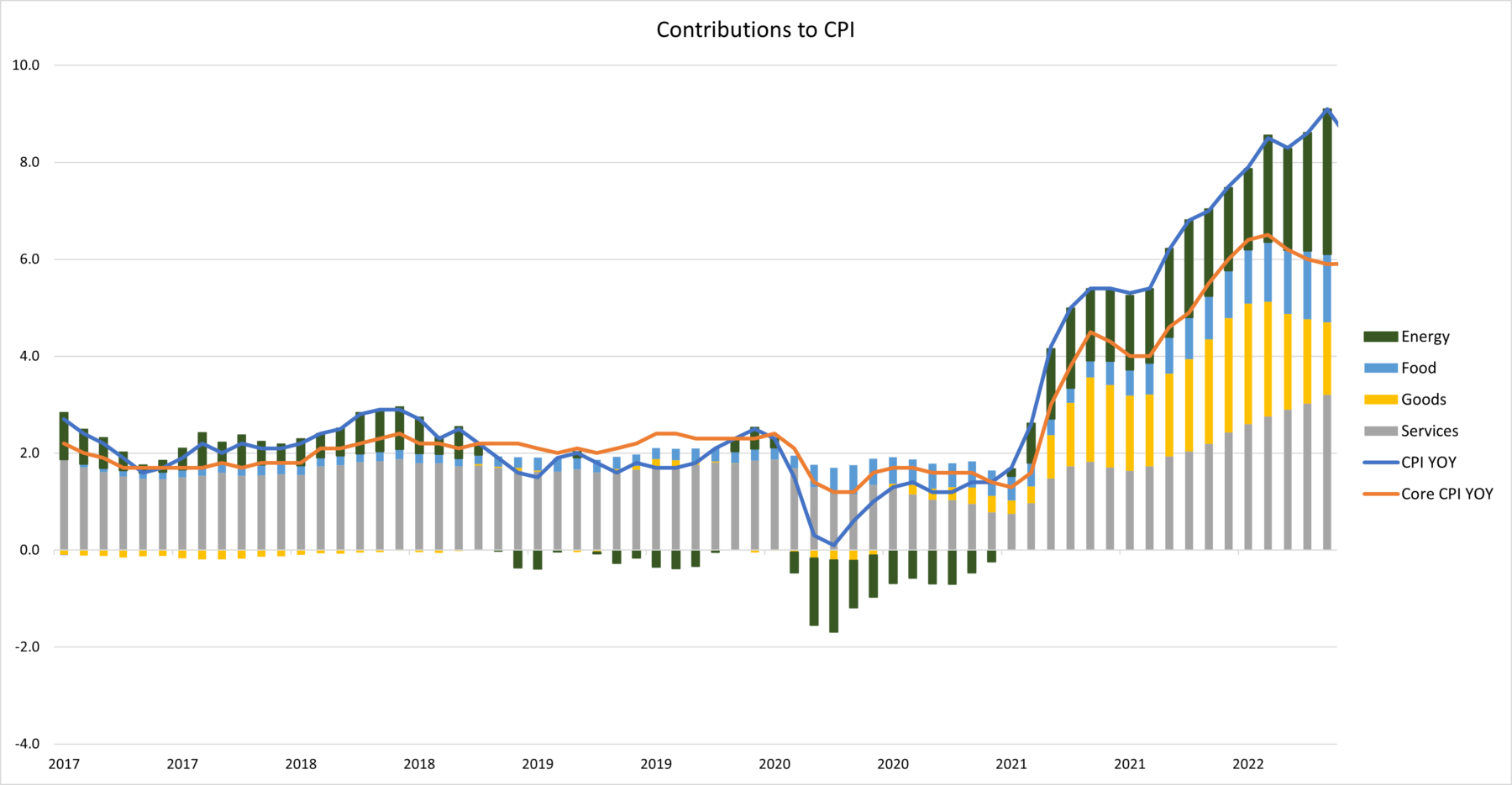

Central banks across the globe are implementing restrictive policies as well to varying degrees. The initial spike in prices was largely a result of energy and goods inflation, but those have stopped rising as quickly, and services inflation has become a larger contributor (Figure 3). Services inflation is a factor that lagged the price changes in most other areas of the economy as a large component of services inflation is shelter, which Fannie Mae believes lags the actual housing market for up to five quarters (1). This makes sense, as we saw home prices appreciate through the second half of 2020 and all of 2021, but services inflation remained relatively benign. Looking forward, we find more reason to believe inflation could fall quickly then remain elevated near its current pace the next year to year or two.

Leading indicators of energy and goods inflation have fallen quickly, and leading indicators of shelter inflation are beginning to show signs of weakness as well. Second, we believe the hawkish monetary policy pivot will couple with the slowing of global growth to create destruction in consumer demand. Still, we remain sympathetic to the risks in the economy that could cause inflation to remain elevated for a longer period of time, and we consider this to be a factor we watch day by day. We see the most probabilistic scenario is inflation falls quickly during the next 12 to 18 months but remains in a more elevated trend over the long term relative to what we experienced pre-Covid.

What is our outlook for Fixed Income?

Although typically looked at as a more defensive asset class, bond market volatility has reached levels last seen in 2008. These levels have caused fixed income returns to largely suffer throughout this year, and year to date, most major fixed income indices are down more than 15%. We expect bond market volatility to remain high as global monetary policy authorities continue tightening financial conditions to slow inflation.

The U.S. Federal Reserve is planning on raising rates into 2023, but we expect the pace of increases to slow. They will likely pause rate hikes in 2023 in an attempt to keep the Fed fund rates elevated for an extended period. While the Fed plans to leave rates at a sustained high level, market participants are already pricing in rate cuts coming in late 2023.

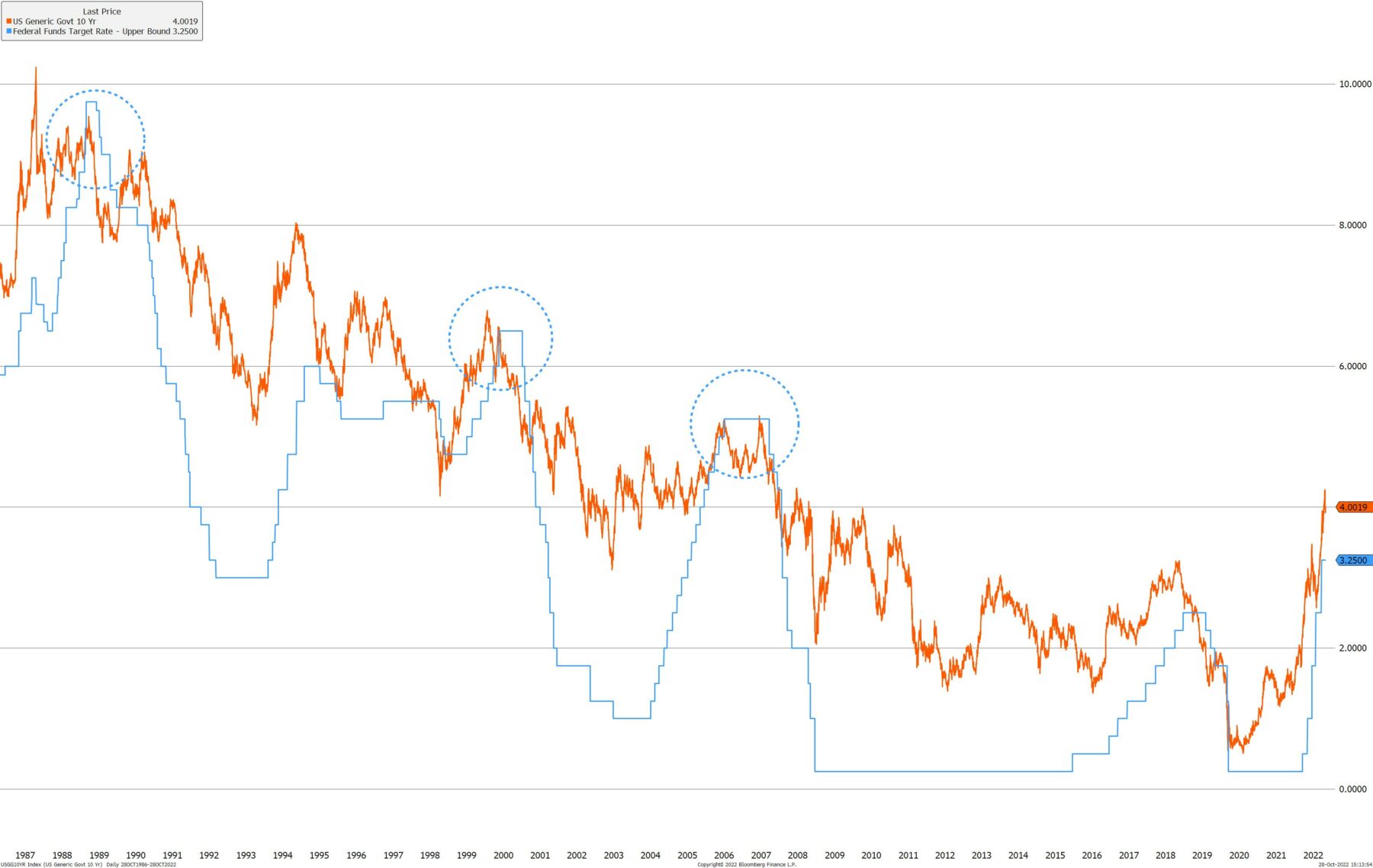

In previous rate hike cycles, as the Fed fund rates began to peak, intermediate government bond yields tended to converge to the Fed funds rate. Typically, this marked the peak in the Fed funds rate and bond yield for that cycle (Figure 4). If this trend is to continue, intermediate- and long-term bond yields could still face some upward pressure as the Fed completes this rate hike cycle.

How long bond yields remain elevated depends on the effects of Fed policy. If the Fed can keep interest rates higher for longer without throwing the U.S. economy into a recession, it is likely bond yields will remain elevated. If tighter financial conditions slow the economy too much, it is likely the Fed will have to cut rates much sooner than they expect. Over the last six rate hike cycles, on average, the Fed was forced to lower interest rates after just 9.5 months. While bond market volatility has been high this year, we are excited about the opportunities emerging. Bond yields, unlike the previous ten years, are starting to look very attractive. Both taxable and tax-exempt municipal bond yields are at their highest levels since 2008. Higher bond yields benefit savers through increased yield opportunities and higher diversification effects when paired with stocks. We plan to remain defensively positioned in bond portfolios with our main objective being capital preservation. As interest rates begin to peak and bond market volatility normalizes, we will start to consider more interest rate sensitive opportunities.

What is our outlook for the stock market?

Throughout the last decade, most stock market investors have viewed intra-year drawdowns as an opportunity to “buy-the-dip”, but we think there is an important distinction between a correction and a bear market. Corrections are often driven by technical, or short- to medium-term factors, while bear markets are usually driven by fundamentals. We were strong believers going into the year the fundamental picture for equities looked less optimistic than previous years. As a result, we have been largely underweight stocks in portfolios for most of the year. We remain defensive on equities as we see a higher probability earnings expectations are revised lower for 2023 and 2024.

Still, we remain dedicated to searching for opportunities to add to equities. Going into the year, we believed the biggest risk to equities was the headwinds they faced from rising rates in the form of lower valuations. Today, the valuation picture for the stock market looks very different, and multiples are much closer to long-term averages.

Still, elevated interest rates and bond yields pose a threat to stock market valuations. For this reason, we are looking for a peak in yields to start getting more optimistic on reallocating to equities. Where we do find value within the stock market right now is in high quality companies that have been hard hit with the volatility. Over long periods of time, dollar cost averaging into companies with high quality balance sheets and stable earnings growth has proven to be profitable.

How are we investing in portfolios?

We remain dedicated to being defensively positioned but on the search for opportunity. We shifted assets away from equity risk through the first half of the year, and while we were largely underweight bonds to start, we have deployed capital into the higher yields we are finding in the fixed income market. We have also allocated to opportunities in short-term treasuries with a much higher yield than we have seen in the last two decades, cash alternatives with floating rate yields that help preserve capital, and opportunistic fixed income.

We believe one of the most important aspects of investing in a volatile market is having a plan. We continue to refine our outlook for equities and the plan we will follow to reinvest into these lower equity prices. Timing the market has proven to be a fool’s errand for some time, but following a plan based on fundamentals helps take the emotion out of making larger investment decisions.

Volatile markets, similar to what is faced today, are times we are reminded of the quote from Jeremy Grantham below. This quote was pinned in early 2009, and in the depth of the financial crisis, after the collapse of Lehman Brothers.

“Be aware the market does not turn when it sees light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before”

Jeremy Grantham, Reinvesting When Terrified, March 2009

References:

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.