Acumen’s Investment Objective: Understanding Risk

Acumen is dedicated to protecting our clients’ capital while growing their assets long-term. Our investment philosophy emphasizes a quality-first approach to balance risk and return, tailored to each client’s specific situation, risk capacity, and preference, culminating in their Investment Objective. We want to remind clients of the importance of their Investment Objective and provide additional perspective on balancing risk and return in Acumen portfolios over the long term.

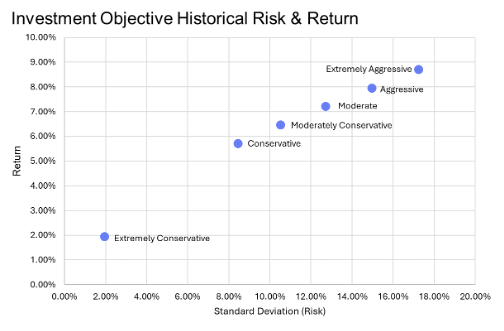

As a refresher, a client’s Investment Objective establishes an appropriate asset allocation (see chart below) based on their preferences, psychology, and overall situation, including interests and assets outside of Acumen. Defining this objective helps align the risk-return profile with the client’s capacity and tolerance for risk, which can change over time. Thus, we review Investment Objectives during each client’s Comprehensive Review meeting and whenever necessary to address any evolving financial circumstances.

While risk often has a negative connotation, in investing, it simply refers to outcome uncertainty. Higher risk leads to greater variation in expected outcomes, so the goal is not to avoid all risk at the expense of long-term growth.

Summary. Investors tend to have varying tolerance for risk. While risk can take many shapes, it can be summarized as the degree of uncertainty associated with an investment decision. Most investors focus on volatility as a measure of risk. Acumen utilizes the principles of Modern Portfolio Theory (MPT) to offer clients six options for long-term portfolio management, each designed to balance risk and return according to individual investor profiles.

Risk refers to the degree of uncertainty associated with any investment decision. The three main types of risk in investing can be summarized as: liquidity risk, risk of permanent loss, and volatility. Liquidity risk refers to the possibility an investor might have difficulty buying or selling an asset at the desired time or price. Risk of permanent loss refers to the possibility of an investment’s value dropping to zero – exemplified by Enron stock in the early 2000s. Volatility refers to the degree of fluctuation in an investment’s value over time, encompassing the ups and downs of an asset or a portfolio of assets.

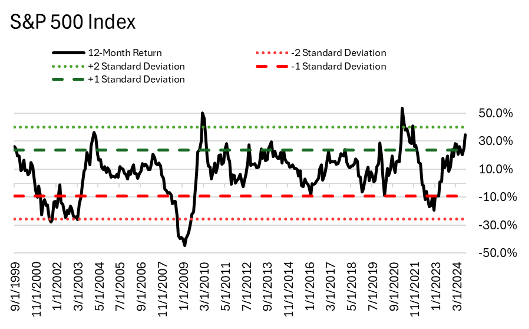

Most investors are focused on volatility when assessing risk. While risk of permanent loss and liquidity risk are no less important, they are easier to mitigate through robust due diligence and a well-diversified portfolio. Volatility is commonly measured as the standard deviation of returns for an asset. Standard deviation measures how much an asset’s returns deviate from its average over a period. A higher standard deviation indicates higher volatility in returns. Returns for an asset should fall within one standard deviation of the average 68% of the time, and within two standard deviations of the average 95% of the time.

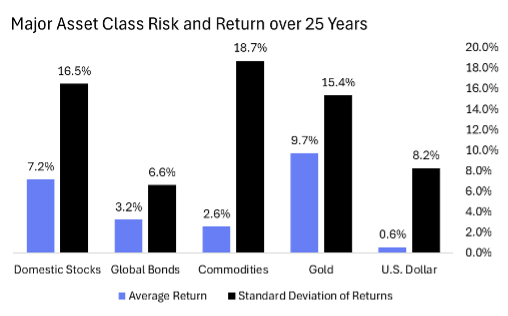

Asset Types and Volatility. Different asset types have different levels of volatility, stemming from the fundamental nature of each asset class. Stocks represent ownership in a company and are more susceptible to changes in market sentiment and company performance. On the other hand, bonds represent a loan to the issuer with predetermined payment terms, offering more stability but typically lower potential returns.

Acumen utilizes MPT to offer clients options based on risk capacity and preference. In the early 1950s, Harry Markowitz received a Nobel Prize for his work on Portfolio Selection. In the paper, Markowitz developed a mathematical framework which could be used to build a portfolio of investments, made up of different asset classes, to maximize the expected return for a given level of risk (volatility). As individuals have varying risk capacities and perceptions, all investors should not be filtered into one portfolio. As a result, we offer six investment objectives for clients – ranging from Extremely Conservative to Extremely Aggressive. Using the principles laid out in MPT, we can better understand the historical return and risk of each, offering clients options based on their preference and capacity for risk over the long term.

Disclosures

Information used in this commentary was obtained via Bloomberg L.P. as of 10/31/2024.

This illustration represents an efficient frontier composed of the Russell 3000 (Domestic Equity), MSCI ACWI ex-U.S. (International Equity), and the Barclays U.S. Aggregate Bond Index (Fixed Income). The intent is to illustrate the historical risk and return relationship over an extended period of time. Historical equity returns represented by Russell 3000 Index and the MSCI ACWI ex-U.S. Index with a time period of 1997 – 2022. Historical fixed Income returns represented by Barclays U.S. Aggregate Bond Index with a time period of 1997- 2022. The Russell 3000 Index® measures the performance of the 3,000 largest U.S. companies based on total market capitalization. The MSCI ACWI ex USA Investable Market Index includes large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US. Barclays.

U.S. Aggregate Bond Index is the most common index used to track the performance of investment grade bonds in the U.S. and is weighted accord- ing to market capitalization. Extremely Conservative model historical returns are from the Bloomberg Treasury Bill Index that tracks the market for treasury bills issued by the US Government with a time period of 1997 – 2022. US Treasury bills are issued in fixed maturity terms of 4-, 13-, 26- and 52- weeks. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Acumen uses multiple other investment options to further diversify each asset class. Some examples of assets that could be held as equities may include international, small cap, commodities, alternatives, emerging markets, etc. Similarly, for the fixed portion of the allocation actual holdings may include high yield, floating rate, preferred, etc. Acumen uses broad discretion to determine if an asset is better classified as equity or fixed income. The actual performance of those asset classes may vary significantly from the benchmark illustrated in the above graph. This investment objective is executed on the household level and not per account, which will result in varying risk per each individual account. Diversification does not protect against loss of principal. Past performance is no guarantee of future returns. Standard Deviation is the statistical measurement of spread or variability from the historical return. Historical returns are not intended to be forward-looking and should not be viewed as an indication of future results. Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.