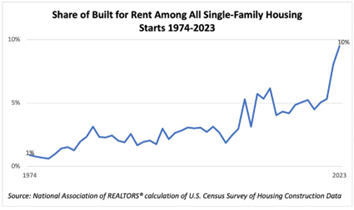

Build-to-Rent Construction Reaches All Time High

Build-to-Rent (BTR) is the concept of new single-family home construction for the intent of renting. These purpose-built new construction rental communities feature a mix of attached and detached single-family homes. Most BTR communities consist of 50 or more homes or townhomes operating similarly to multifamily properties. The locations are often transit-oriented locations in close-in suburbs as well as desirable tertiary markets.

Many BTR developments are designed with high-end amenities such as community pools, clubhouses, greenspaces, walking trails, and dog parks. Some communities even offer features such as shared gardens and pickleball courts. They are typically comprised of high-quality homes and town homes, owned by a single entity, with professional property management. The property management team generally handles leasing, repairs, maintenance, amenities, and landscaping. For some renters, the BTR model combines the best aspects of single-family rentals and elevates the experience by bundling homes inside a professionally managed community.

The Build-to-Rent sector is relatively new with one-quarter of properties built in the past three years. According to CBRE, the typical multi-family apartment unit offers an average size of 1,150 sq ft. The single-family detached and townhome BTR properties generally range between 1,500 and 2,000 sq ft. An apartment may not have enough square footage for some renters. With the rise of hybrid work, many renters desire space for a home office, a yard for a pet, and room for a growing family.

(Source – https://www.cbre.com/insights/reports/build-to-rent-overview-2024)

The National Association of Realtors says the share of built-for-rent single-family homes grew from 5% in 2021 to 10% in 2023, thus doubling in two years.

(Source: https://www.nar.realtor/blogs/economists-outlook/built-for-rent-housing-starts-continue-to-increase)

What is driving demand for Built-to-Rent homes? BTR homes are finding renters across all demographics, but especially among millennials. The U.S. Census Bureau estimates 65% of Americans under the age of 35 currently rent.

According to a Bankrate study, a typical home costs nearly 37% more to buy than rent on a monthly basis. Rent increases have softened across the U.S. over the last year, but the combination of high home prices, interest rates, and low housing supply creates challenges for potential homebuyers.

It is cheaper to rent than to buy in the top 50 metros. The typical monthly mortgage payment of a median-priced home ($412,778, per Redfin) in the U.S. is $2,703. The national typical monthly rent is $1,979 as of February – a 36.6% difference. In 21 U.S. metros, the monthly cost of owning is at least 50 percent more expensive than the monthly cost of renting.

Given the cost of homeownership, it seems the Build-to-Rent model will remain a desirable rental option. Despite this, nearly four in \five Americans (78%) say owning a home is part of the American Dream, according to Bankrate’s Home Affordability Report. The largest factors holding non-homeowners back from purchasing were reported as lack of income (56%), home prices being too high (47%), and not being able to afford the down payment and closing costs (42%). For many sidelined buyers to enter the market, they need lower rates and more available supply of lower priced homes.

(Source: https://www.crowdstreet.com/resources/properties-perspectives/build-to-rent-what-to-know-about-btr)

(Source: Study Shows Renting Is More Affordable In The 50 Largest Metros | Bankrate)

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change.