Commentary on Recent Market Volatility

Market volatility has remained relatively quiet throughout 2024. The VIX Index – often referred to as the stock market’s “fear gauge” – remained below a key psychological level of 20 for the first seven months of the year. Last Friday, markets experienced a reintroduction of volatility. The S&P 500 had already fallen around -4% from its high, but fell around -2% on Friday, August 2nd, and fell another -3% on Monday, August 5th. The U.S. stock market was not alone, as the Nikkei – the Japanese stock index – was down -17.5% over the same two days. The VIX index rose from a relatively low level to a level typically associated with extreme moves in the stock market (Figure 1). Market commentators have suggested both technical and fundamental factors at play for the outsized market moves in such a short period of time. We believe the right answer lies somewhere in the middle and discuss some important points below.

Figure 1 – CBOE VIX Volatility Index

- As we have suggested since 2023, we believe extreme levels of market concentration pose a risk for heightened market volatility. This “concentration trade” began to unwind in the middle of July, as some of the names contributing to market concentration had disappointing earnings results. From July 15th to July 31st, the S&P 500 market cap weighted index was down -2% while the S&P 500 equal weighted index was up +1.75%.

- On Friday, August 2nd, a jobs report came out which announced the Unemployment Rate for the U.S. had moved up to 4.3%, and the U.S. had only added around 100k jobs for the month of July – much lower than the previous month and lower than expected.

- Market participants have leaned on the idea of a tight labor market as the core tenant for a soft-landing scenario. Beliefs in a soft landing have remained high. The last Bank of America Fund Manager Survey showed that 68% of respondents said the most likely scenario for the economy over the next 12 months was a soft landing. Last Friday’s labor market report threw some cold water on these expectations.

- Still, economic growth remains solid. The Atlanta Fed’s real time measure of economic growth shows third quarter growth should come in around 2.9% – higher than the long-term average. Additionally, 4.3% is still a low rate of unemployment compared to history. One factor we are watching is whether a slowdown in the labor market serves as a negative feedback loop for more weakness. Essentially, how much does a slowdown in hiring influence a slowdown in spending, and consequently feed into a further cooling in the labor market?

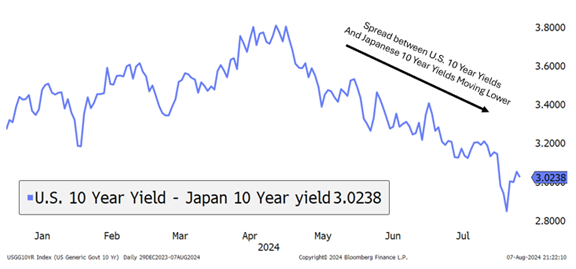

- While there were some fundamental reasons for market volatility, such as market concentration and a disappointing jobs report, we find the outsized move largely driven by technical factors. A key technical factor at play over the previous few days was the unwinding of the carry trade in the Japanese Yen. The carry trade in the Yen is defined as investors borrowing money in Yen and investing capital into areas of investment with higher growth potential like U.S. tech stocks or Japanese Large-Cap stocks – essentially going short the Yen and long stocks. The Yen had become particularly weak over the previous few years relative to the U.S. dollar and was looked at as “cheap” in carry terms.

- Currencies often trade based on interest rate differentials, and the U.S. underwent a period of rapidly rising interest rates while rates in Japan remained markedly low. This interest rate differential was squeezed as the Bank of Japan began normalizing monetary policy, and U.S. rates fell as a result of a weak jobs report. Investors implementing this carry trade were then forced to unwind their Yen short as the currency strengthened, selling popular U.S. stocks and Japanese stocks in the meantime. This technical factor created a negative feedback loop and was a large contributor to the size of the volatility seen in the market over the last few days.

Figure 2 – Spread Between U.S. and Japanese Yields

- One of our largest convictions over the previous few years has been that investors will need to remain active in their approach and maintain a focus on quality. Part of this philosophy is driven by the idea market structure has changed to a point where volatile periods could be larger in size – both to the upside and downside. Our approach for managing exposure to volatility in client portfolios will remain focused on active management, downside protection, and high quality. Lastly, volatile periods should be seen as times when the greatest investment opportunities can arise. We continuously review the opportunities set across financial markets.

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involve risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.