Freddie Mac Enters the Second Mortgage Market

U.S. regulators recently approved a pilot program for Freddie Mac to purchase second mortgages. A primary reason for Freddie Mac’s decision is to “provide lower-cost alternatives to existing cash-out refinance products. Many borrowers, particularly low-income borrowers and those in rural and underserved communities, have struggled to access equity in their homes through the private home equity market. In an environment of elevated mortgage rates, borrowers are either forced to give up their below-market rate and obtain a cash-out refinance with a higher mortgage rate across the entire loan balance or are forced to sell their home when a financial need arises, which can create instability for families and run counter to the Enterprises’ missions”

The conditional approval includes the following restrictions:

- A maximum volume of $2.5 billion in purchases;

- A maximum duration of 18 months;

- Maximum combined loan-to-value of the first and second mortgages cannot exceed 80 percent

- A maximum loan amount of $78,277, corresponding to certain subordinate-lien loan thresholds in the Consumer Financial Protection Bureau’s definition of Qualified Mortgage;

- A minimum seasoning period of 24 months for the first mortgage; and

- Eligibility only for principal/primary residences.

Upon the pilot program’s conclusion, regulators would analyze the data to determine if the objectives of the program were met and potentially create an expanded program.

What is the impact of this? Owner’s equity is around the highest in modern history providing access to cash for other needs and facilitate owners retaining ultra-low first mortgage rates. It may unlock funds for home improvements and owners remain in existing homes for longer than typical.

If the pilot program is considered successful, expansion of the program is likely, and Fannie Mae would likely join. The $78,000 pilot program limit may also be increased in future iterations. There are still many unknown details, but the ability for consumers to tap equity could provide monthly payment relief via debt consolidation (credit card, car loans). Equity may also spur consumer spending or provide liquidity for emergency funds.

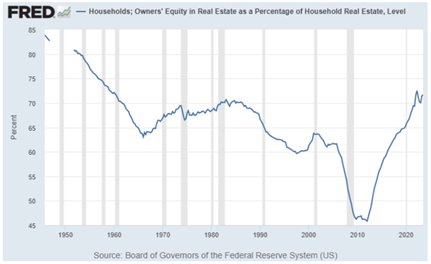

Owner’s Equity in Real Estate

- Leading up to 2008, owner’s equity in real estate (as a percentage of total real estate value) reached record lows (highly leveraged)

- Today, owner’s equity is around the highest in modern history

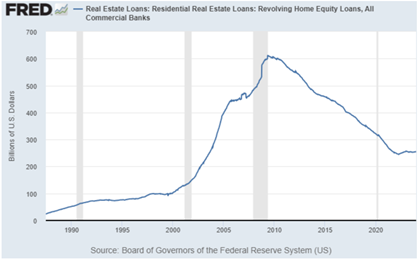

Home Equity Loans

- The lead up to 2008 was unusual with the amount of home equity lending

- Home equity loans outstanding are the lowest since the late 1980’s as a percentage of real estate value

Second mortgages have widely been available through banks, but a Freddie Mac program may invite many more applicants to apply. Second mortgages may provide more favorable terms (both rate and longer amortization) and have less restrictive underwriting criteria (perhaps eligibility for lower credit scores) compared to community and regional banks.

In conclusion, if the program is expanded this may unlock needed capital for many borrowers. We could effectively see less housing supply as owners remain in their homes for much longer than historical norms. This may also help owners achieve better monthly cash flow through debt consolidation and help prevent future distressed sellers. Conversely, this second mortgage would likely reduce some lower risk loans from bank balance sheets as they are replaced by Freddie Mac. Longer term, banks will need to replace lost loan volume and which may be with a riskier loan profile. We will monitor the pilot program findings and better gauge the overall impact in the coming months.

The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change.