Housing Market: A Time to Pass or Time to Buy?

The pandemic has created a list of scarce items. We continually hear about the latest shortage or backordered item on a daily basis. We continue to experience scarcity in nearly all sectors, from lumber to microchips to dumbbells, and – yes – houses. For buyers, securing a new home under contract may even feel like finding the last package of toilet paper when Covid-19 first struck.

The supply of homes simply cannot keep up with demand. But is this transitory or will this be a persistent supply and demand imbalance in the years ahead? Let’s explore some reasons why the housing shortage (in certain markets) may not end anytime soon.

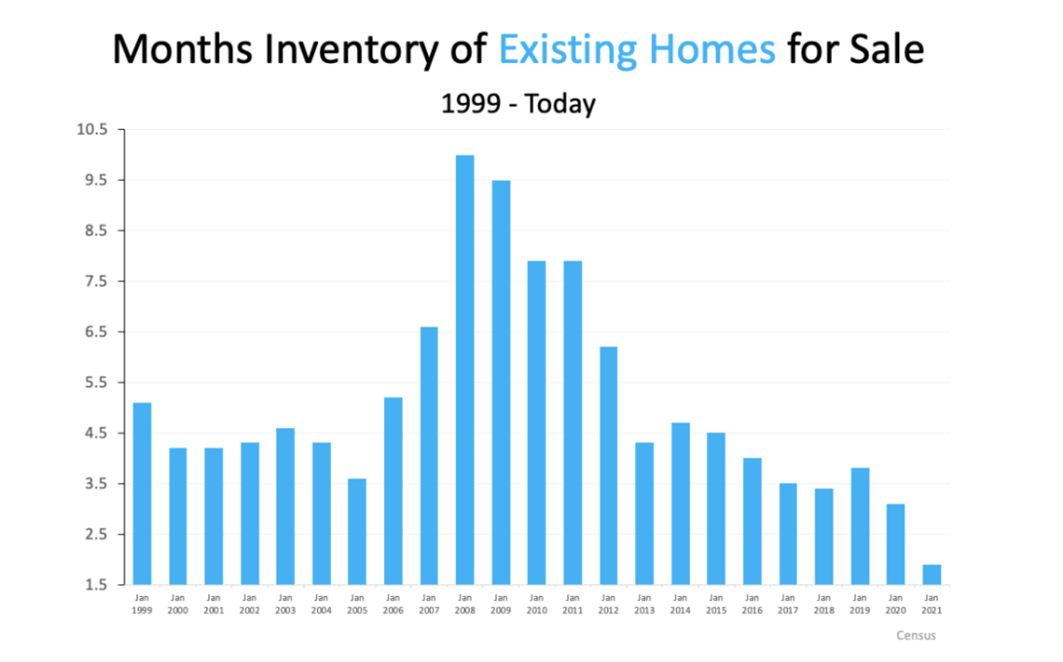

Inventory

If we look back to 2007 and 2008, we can easily see the massive supply of inventory leading up to the financial crisis of 2008. A healthy supply of homes on the market is generally considered to be six months or less. In 2008, we reached a 10-month supply. Fast forward to 2021 and you see the supply is under two months. In a number of hot markets, supply is as low as 12 days!1 This means, if new sellers did not list their homes for sale, the supply would be depleted in 12 days. Homebuyers today are purchasing for many healthy reasons. We see increased flexibility to work from home, increased savings, and low interest rates driving purchases.

Chart Source: https://gohomene.com/hope-is-on-the-horizon-for-todays-housing-shortage/

1Source: https://www.wsmv.com/news/nashville-ranks-2-in-the-u-s-for-fastest-selling-homes/article_8ff73a94-d078-11eb-ab79-033c5ff5e4db.html

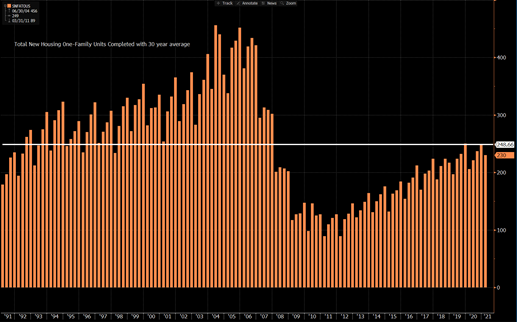

Underbuilt New Construction

The graph, shown below, goes back to the early 90’s and shows a 30-year average of single-family construction units completed. Most years were slightly overbuilt for the average and, leading up to 2008, single-family homes well exceeded the average. The years leading up to 2008 were marked by overbuilt new construction speculative homes. Credit standards were considerably relaxed compared to post 2008 credit reform. Many builders built speculative housing without presales and many buyers were purchasing speculatively for pure investment. As the oversupply of inventory from 2008 and 2009 was absorbed, builders were experiencing the Great Financial Crisis. Many builders left the industry and lending standards became considerably more stringent for builders.

As a result, we have the lowest volume of new construction homes in decades, placing us below historic levels in terms of meeting demand. This demand has created support for single-family housing and rental values. A lack of construction workers and lack of available buildable plots contributed to the housing shortage and is not likely to improve in the near term.

Source: Bloomberg as of May 24, 2021

Housing Cost Relative to Income

Is housing too expensive? It definitely “feels” expensive to those watching prices increase. Home prices have surged and building costs are spiking due to increased prices of raw materials. In spite of this, housing costs, as a percentage of disposable income, is well below the 35-year average. This is largely due to low financing costs. We believe increasing wages will also contribute to affordability in the future.

Many headlines are quick to emphasize the fact homes are less affordable than last year. Black Knight, a leading provider of data and analytics across the home ownership life cycle, recently reported on this issue. The findings show the historical averages of the national payment to income ratio defined as “the share of the median income needed to make the monthly payments on the median-priced home.”

The findings report the historical averages of the national payment to income ratio as follows:

- The average over the last 25 years was 23.6%.

- The average over the last 5 years was 20.1%.

- The average today stands at 20.5%.

Source: https://cdn.blackknightinc.com/wp-content/uploads/2021/06/BKI_MM_Apr2021_Report.pdf

This graph below further illustrates the household debt as a percentage of disposable income is at all-time lows since 1986.

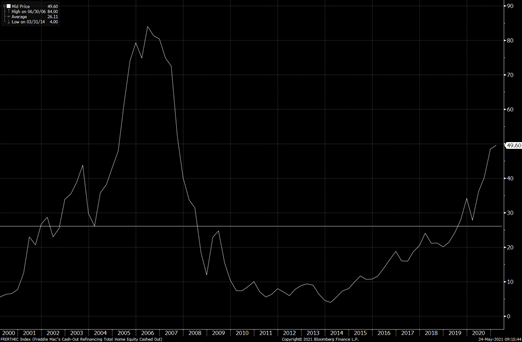

Current Amount of Leverage

One of the warning signs in the housing market is observing too much leverage. As this chart below shows, cash out refinancing leverage utilization was high from 2005 to 2007 as many consumers took out equity to purchase speculative investments or use for consumer spending. In recent years, we see a gradual uptick in cash out leverage, but still far below 2006 levels. Credit has remained limited for cash out refinances and many consumers are using cash out proceeds to undertake home improvements which should increase the value over time.

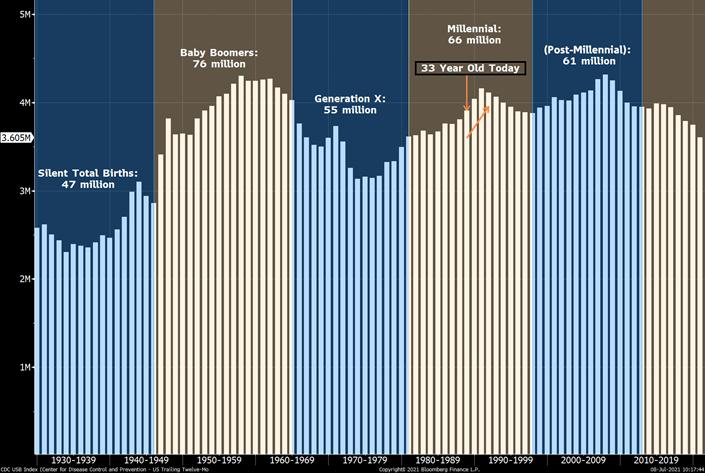

Demographic Tailwinds

Even before the pandemic, millennials were buying homes and boosting housing demand. With homeownership rates rising around age 30, the millennial buyers are likely to increase. The baby boomers have long been the largest demographic group but, watch out – the millennials are here. While millennials are delaying the purchase of their first home, there are demographically greater numbers of millennials reaching prime home buying age. Becoming a homeowner as a young adult can often be a foundational step toward future wealth accumulation. With low rates, new hybrid work from home situations and household formations, millennials are likely to continue purchasing homes.

Source: CDC as of July 8, 2021.

Migration Trends

Goodbye California and Hello — Tennessee??? If you think Tennessee is a great place to live, you are in good company! A line of U-Haul customers is ahead of you, too. Tennessee posted the largest net gain of U-Haul trucks in 2020, making Tennessee the No. 1 U-Haul growth state for the first time. Growth states are calculated by the net gain of one-way U-Haul trucks entering a state versus leaving the state in a calendar year. Rounding out the top three was Texas and Florida. Our neighbors North Carolina and Georgia came in ninth and tenth, respectively.

Tennessee, Texas, and Florida all have no state income tax and are business-friendly states. Many people are attracted to our lifestyle, low cost of living, climate, and the great outdoors.

2020: STATES RANKED BY MIGRATION GROWTH

| 1. | Tennessee (12) |

| 2. | Texas (2) |

| 3. | Florida (1) |

| 4. | Ohio (7) |

| 5. | Arizona (20) |

| 6. | Colorado (42) |

| 7. | Missouri (13) |

| 8. | Nevada (24) |

| 9. | North Carolina (3) |

| 10. | Georgia (16) |

| 11. | Arkansas (23) |

| 12. | Indiana (9) |

| 13. | Wisconsin (41) |

| 14. | Oklahoma (14) |

| 15. | South Carolina (4) |

| 16. | West Virginia (22) |

| 17. | Utah (8) |

| 18. | Kentucky (37) |

| 19. | Montana (26) |

| 20. | Minnesota (15) |

| 21. | Kansas (18) |

| 22. | Alabama (6) |

| 23. | New Hampshire (31) |

| 24. | Iowa (30) |

| 25. | South Dakota (28) |

| 26. | Vermont (10) |

| 27. | Delaware (21) |

| 28. | Virginia (39) |

| 29. | Maine (33) |

| 30. | Idaho (11) |

| 31. | Mississippi (25) |

| 32. | Nebraska (19) |

| 33. | Wyoming (27) |

| 34. | Alaska (17) |

| 35. | Rhode Island (35) |

| 36. | Washington (5) |

| 37. | North Dakota (32) |

| 38. | Washington, D.C. (38)* |

| 39. | New Mexico (36) |

| 40. | Michigan (48) |

| 41. | Pennsylvania (46) |

| 42. | New York (43) |

| 43. | Connecticut (34) |

| 44. | Louisiana (40) |

| 45. | Oregon (29) |

| 46. | Maryland (45) |

| 47. | Massachusetts (47) |

| 48. | New Jersey (44) |

| 49. | Illinois (50) |

| 50. | California (49) |

Is it still a good time to own single-family residential real estate? Given the strong demand, limited supply, large population of millennials, and the low payment relative to income, we believe this is still a great time to buy – with one qualifier. Where you buy!

We believe the Southeast is poised for continued migration by businesses and individuals. Single family housing in growth markets may be emerging as a safe haven investment. In addition to migration trends and new business bringing prospects to the area, there is a strong interest in tourism in the Southeast as well. Popular tourist vacation areas like the Smokies and Blue Ridge are seeing record numbers of tourists and visitors to the national parks. Vacation rental homes and investment properties in select markets may also present a unique buying opportunity. Tennessee and neighboring Southern states are among the top-performing markets in the country and likely to continue.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.