Medicare Premiums and Income Levels

Many Medicare beneficiaries are surprised by their high Medicare premiums whether they are an existing or first year Medicare recipient. The correlation between modified adjusted gross income and the cost of Medicare premiums is important and should be considered.

Often people are unaware of the income-related monthly adjustment amount (IRMAA) which is a surcharge added to Medicare Part B and Part D. Since 2007, high-income Medicare recipients have been required to pay the surcharge in addition to their monthly premium. If nearing desired retirement age or not, understanding IRMAA and its appeals process may be helpful crafting a proactive plan to potentially reduce future Medicare premiums.

Premiums increase as income increases. For high-income Medicare beneficiaries, Part B and Part D premiums include an additional charge based on modified adjusted gross income. If income increases by even one dollar into the next range, the surcharge will be higher. The surcharge is for only one year beginning two years after it is reviewed.

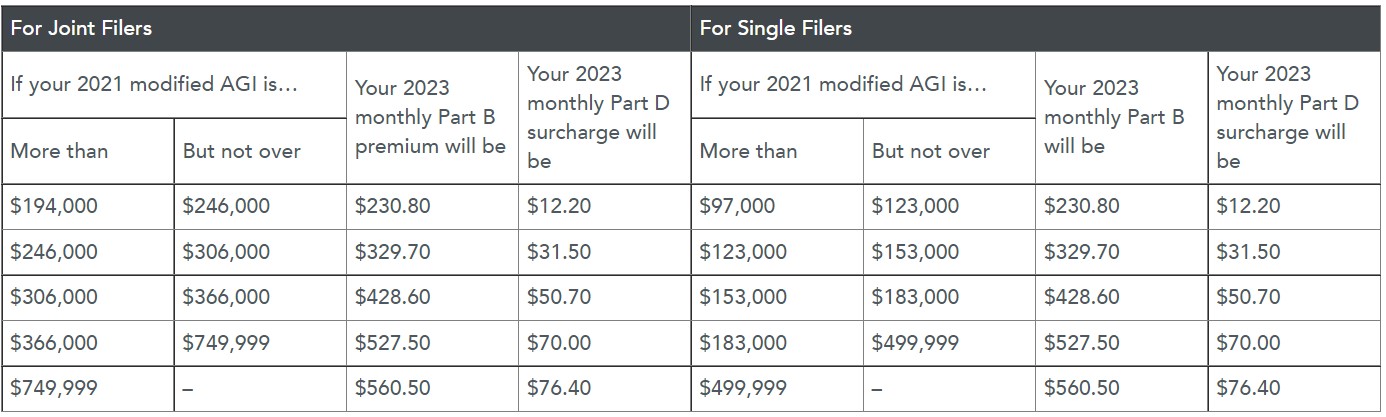

Medicare Part B covers doctor visits and outpatient services. In 2023, the base premium will be $164.90 per month, and those who are subject to the surcharge should plan to pay between $230.80 and $560.50 per person per month. Part D covers prescription drugs and the monthly cost depends on the plan. The income surcharge ranges from $12.20 to $76.40. The tables below show the sliding scale for determining IRMAA for Part B and Part D.

Premiums are reviewed every year which means premiums may go up and down throughout life depending on income during the prior two years. Because Medicare eligibility can begin at age 65, and because premiums are based on income during the prior two years, consider income level and how it will impact Medicare premiums when turning 63.

One example would be a couple employed in 2022 with an income of $250,000. If they begin Medicare Part B and Part D in 2024, the additional cost, above and beyond the base premium, would be $392.60 per month, as a couple. This premium is an additional expense of $4,711.20 expense for 2024.

In certain circumstances, such as a “life-changing event,” the increased premium can be appealed. If planning to retire in 2023, a recipient will have a significantly lower income going forward. Enter the appeals process. For example, retirement is a legitimate reason for the Administration to lower the premium if income drops significantly after leaving the workforce. Retirement is the most common life change possibly resulting in a reduction of the surcharge. But it is not the only one. Reduced work hours, marriage, divorce, death of a spouse, and a few other reasons might also warrant an appeal.

If the income is higher due to a one-time event, rather than a life-changing event, it may not be worth the time to appeal. Some situations, unlikely to obtain approval for a reduction of premium, are property sale resulting in unusually high capital gains, deferred IRA withdrawal, or Roth IRA conversion.

It is important to be aware of the impact these one-time events can have on premiums so one can weigh the pros and cons of receiving a higher income. The recommendation is to properly

plan for future Medicare premiums in your budget or, if possible, modify your strategy so you do not move into the next premium range.

Importantly, for the one-time events, the higher income will impact premiums for only one year, beginning two years after the income spike.

If you believe you have a case for appealing a higher Medicare premium, you can request a review by completing the Form SSA-44 and providing supporting documents; these can be faxed or mailed to the Social Security Administration office.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. All information is current as of the date of herein and is subject to change without notice. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.