Q1 2026 Investment Commentary

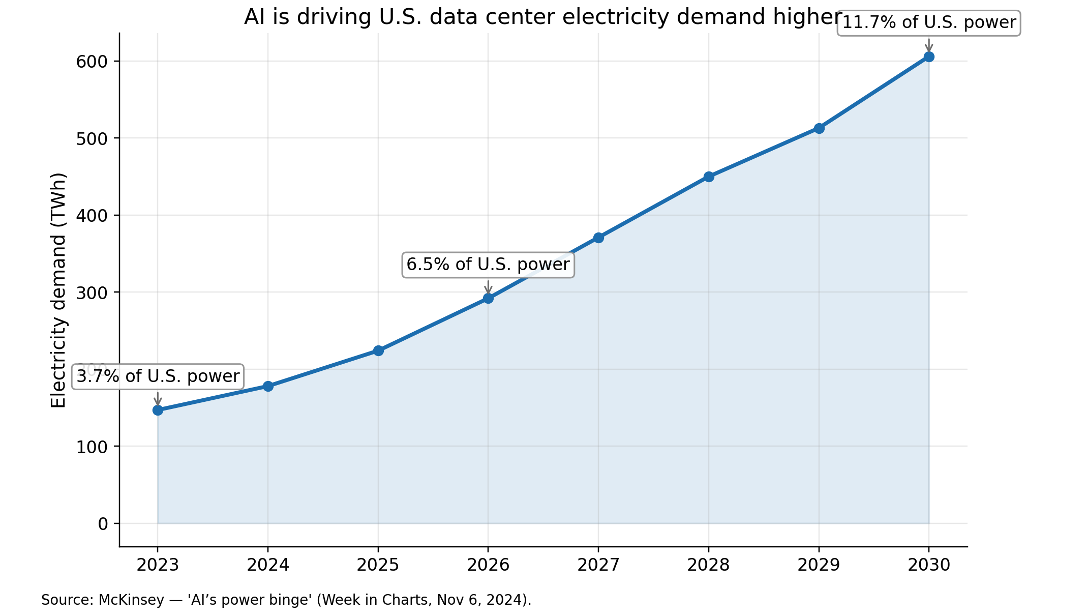

2025 closed with resilience. In many cases, accelerating growth, cooling inflation, and elevating market valuations were due to a strong Artificial Intelligence (AI) infrastructure buildout. The S&P 500 index finished the year upwards by over 17%. This increase was despite a correction of more than -10% from the start of the year to April 8th. The MSCI ACWI ex USA index was the biggest winner in 2025, gaining over 30%. They benefitted from a weaker dollar and relatively low valuations. Bonds benefitted from falling interest rates at the short to intermediate end of the yield curve. They finished the year with total returns in the range of 4% to 7%.

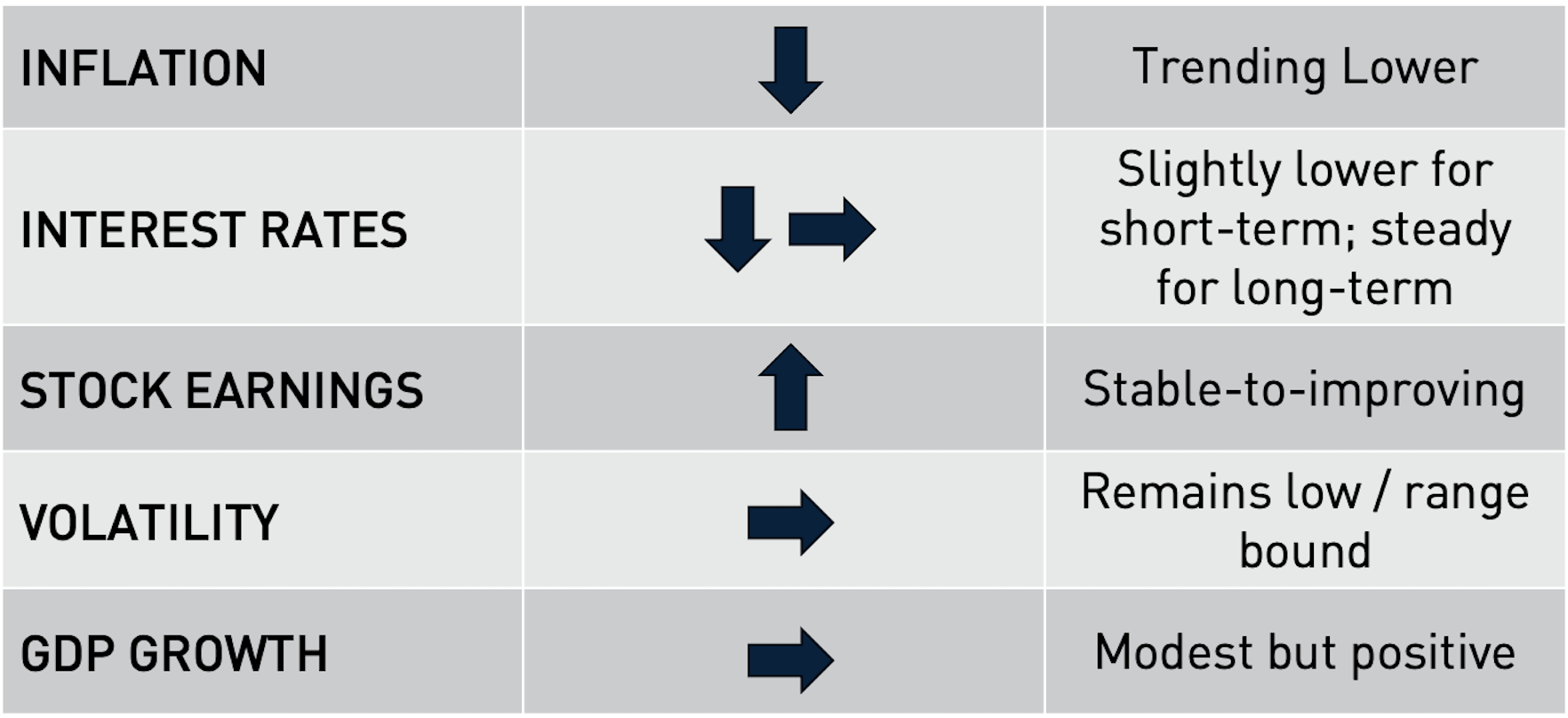

As we enter 2026, the U.S. economy appears to be settling into a healthier, more balanced phase. Growth is expected to remain positive, and while the pace should slow modestly, it continues to point toward a “soft landing” rather than a recession. Inflation is gradually easing toward the Federal Reserve’s target, helped by improving supply conditions and continued productivity gains. Some early-year pressures—such as higher import costs tied to tariffs and slower population growth—should fade as the year progresses.

Interest rates are also expected to stabilize. After cutting short-term rates early in the year, the Federal Reserve is likely to pause and observe how the economy evolves. Longer-term borrowing costs may not fall as quickly, but they are expected to remain within a relatively steady range. For households and businesses, this means a more predictable backdrop for borrowing, investing, and planning.

Financial markets begin 2026 on solid footing. Stock valuations are higher than historical averages, but companies are still delivering healthy earnings, helped in part by ongoing investments in technology and productivity. Market sentiment is generally constructive, and despite occasional uncertainties, investors appear neither overly optimistic nor overly fearful. Bond markets also remain steady, though current pricing leaves some room for modest increases in credit spreads as conditions normalize.

Given this environment, a balanced and thoughtful approach to investing continues to make sense. Market volatility remains low, and strategies to manage risk are still relatively inexpensive. A slightly softer U.S. dollar and stable financial conditions globally can support diversification. Overall, focusing on high-quality companies, maintaining discipline, and staying flexible as economic trends unfold are likely to serve investors well throughout 2026.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. The information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involve risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

The MSCI ACWI ex USA Index tracks large and mid-cap stocks from Developed Markets (excluding the U.S.) and Emerging Markets, aiming to capture about 85% of the global equity opportunity outside the United States, providing broad exposure to international stocks, including developed and emerging nations, minus U.S. companies, as a benchmark for investment performance.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors®, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors®, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors®, LLC unless a client service agreement is in place.