Q2 2022 Market Commentary

The first half of 2022 was difficult for financial markets. The S&P 500 was down 20.6% and the aggregate bond market (Bloomberg Barclays U.S. Agg) was down 10.5% as of 6/30/2022. This means a traditional 60/40 portfolio was down more than 16% through the first half of 2022. For context, if we go back to 2020, the year that brought a pandemic and a global economic shutdown, we see this same 60/40 portfolio down 10% through the first three months of the year and up 0.5% after six months. However, a key difference between these two periods has created a dispersion in the performance of this traditional balanced portfolio. 2020 brought about an exogenous shock to economic growth and was a deflationary event. As a result, monetary policymakers stepped in and provided every bit of support they could by targeting 0% interest rates and buying up financial assets to provide liquidity. Bond yields plummeted, continuing a multi-decade long downward trend in yields, and the equity market began to quickly recover as investors were more willing to look toward a brighter future with the hurdle rate for investment (interest rates and bond yields) now close to zero.

Today, we are facing a much different scenario where inflation has become entrenched in the global economy and is beginning to slow the outlook for growth. The Federal Reserve (Fed) is doing the exact opposite of what they were doing in 2020 and is now implementing restrictive policy to help battle inflation. Due to the shift towards restrictive monetary policy, bond yields have climbed quickly, both hurting fixed income returns and bringing the hurdle rate for equity investments to a much higher level amidst a period where corporate profits are likely to slow.

Figure 1 – Long-Term Trend in Bond Yields

What matters most is to be forward looking in our approach and try to understand the probabilities of what could happen over the next 12 to 18 months. We typically start with our outlook on the broad economy and try to understand where we are heading in the current business cycle. Going into this year, we believed we were definitively Late Cycle. Today, we continue to believe this is where we ARE, but believe we are trending towards a recessionary environment. As mentioned above, one factor contributing to this idea is the global economy is beginning to show signs of weakness as leading economic indicators are trending downward. Business confidence is also reaching a low. These factors are usually indicative of a movement towards a recessionary environment. Coupled with this, inflation is at a multi-decade high and is beginning to slow the economy down.

The Fed’s rhetoric towards inflation evolved in the first half of 2022 from completely abandoning the word “transitory” to, most recently, fearing “entrenched” inflation. Monetary policy has shifted dramatically this year to one of the fastest tightening cycles in recent history as the Fed is insistent on pulling down inflation by dampening demand. The strong labor market and the recent upside surprises we have seen in headline inflation data, likely validates the Fed’s ultra-restrictive response in their attempt to blunt inflation. We believe inflation will either be stickier than expected, prompting the Fed to become more hawkish resulting in a much harsher tightening cycle, or inflation could fall quickly as the economy slows and demand falls. In either scenario, tightening cycles generally end with the Fed overtightening into a recession; therefore, inflation falling more quickly could imply a milder recession as the Fed will not have to go as far in tightening.

There is a myriad of external supply factors which could affect headline inflation numbers including the war in Ukraine and Covid policy in China; however, we do expect core-inflation (which excludes food and energy inflation) to begin topping out as the economy is pressured by tighter financial conditions and overall demand begins to fall. There is a brighter side of this outlook. From where we sit today, we find little reason to believe there could be extreme financial contagion which caused the equity market to fall more than the 50% during the 2007 to 2008 period. Today, banks are much better capitalized, and the consumer is in a better financial condition. In the same light, a recessionary environment could bring about substantial opportunity in various asset classes.

Fixed income markets have experienced one of the worst starts to a year on record. Higher than expected inflation and restrictive monetary policy has led to bond yields resetting higher resulting in prices falling. Fortunately, we believe the worst might be behind us and bond returns for the second half of the year could be more favorable than the first half. Even with a more favorable outlook, we still expect elevated levels of volatility as the Fed continues to fight inflation.

Key drivers for bond market performance moving forward are the paths of inflation and the response of the Federal Reserve. The Fed has already taken aggressive actions to dampen demand. They have raised the Federal funds rate from 0% to 1.50% over the past three months and plan to bring the rate closer to 3.00% by the end of the year. Central banks rarely succeed in fighting inflation without triggering a recession, and the overall market is already starting to price in higher recession risks. As recession risks increase, we expect longer term bond yields to fall. If the Fed is successful in slowing inflation, which comes at the expense of slowing economic growth, we would expect bond yields across the curve to fall. If inflation remains persistent, we expect short-term bond yields to move higher due to more restrictive Fed policy. Either way, yields are finally at attractive levels, and we favor adding high-quality bonds. We believe the bulk of the bond market selloff is behind us and we do not expect yields to move sharply higher from their current levels. We plan to take advantage of higher yields, but do not want to add credit risk to portfolios. We still expect the rest of the year to be volatile and capital preservation is top of mind for our bond portfolios.

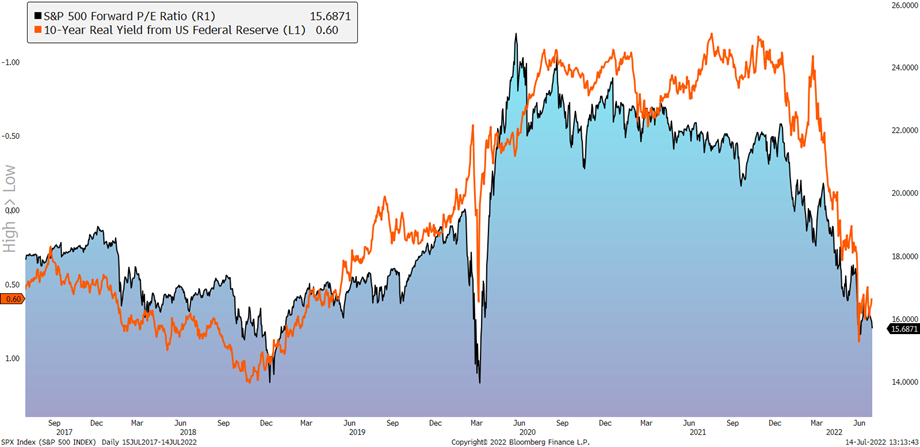

Most major equity indexes posted returns of close to -20% from the end of 2021 through the midway point of 2022. Many factors likely contributed to the negative performance for stocks, such as geopolitical tensions and slowing economic growth, but we believe the largest contribution was from restrictive monetary policy and rising bond yields. Going into this year, we were defensive in our equity allocation. We believed high valuations across the equity market would create a headwind for stock prices, especially with the Fed embarking on restrictive policy and bond yields trending higher. The forward P/E on the S&P 500 is down 35% year to date, showing investors have completely reset their valuation preferences against this backdrop. The chart below shows the forward P/E ratio for the S&P 500 (black) alongside the Real Yield on a 10-Year U.S. Treasury from the Fed. This massive reset in equity valuations is a direct result of the hurdle rate for equity investments resetting to a much higher level.

Figure 2 – Forward P/E on S&P and 10-Year Real Yield

Today, the valuations for the broad equity market are much more attractive than they have been in recent years. This trend gives us some healthy optimism. However, we do see one possible risk remaining for equities and is the primary reason we remain close to our maximum underweight to the asset class. While valuations have fallen back towards their long-term averages, profit expectations for companies are still expected to be close to all-time highs over the next two years. This situation gives us pause as we feel this optimistic profit outlook for corporate America does not necessarily align with a backdrop of slower economic growth and tight financial conditions. However, a positive note here is, when these expectations do reset and more closely reflect reality, there will be a substantial amount of opportunity in the equity market. While we are currently close to our maximum underweight to equity exposure across portfolios, our current plan is to work on building a shopping list of high-quality assets that have gotten hit hard from the recent selloff but pose strong growth characteristics over the long term.

In summary, while the broad economy is likely trending towards a recessionary environment, we do believe the worst in terms of negative asset class performance could be behind us. The massive rise in bond yields against a new backdrop of likely slower growth has provided an environment where bond investors can pick up attractive yields with a greater probability of yields moving lower in the next 12 to 18 months. While the equity market has been hit hard so far this year, valuations for stocks look much more attractive today. They will look even more attractive when the outlook for profits and company fundamentals start to reflect the economic backdrop. While we have been largely underweight risk in portfolios throughout the previous six months and have performed well on a relative basis as a result, we are focused on identifying opportunities to deploy the capital we have put into safer assets. We believe the most lucrative investment strategy is to be greedy when others are fearful. While the largely propagated quote may come off as cliché, it is often the hardest strategy for investors to implement. We remain dedicated to looking for those moments.

Please feel free to reach out regarding any questions you may have.

Sincerely,

Your Acumen Team

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change, as are statements of financial market trends, which are based on current market conditions. The views and strategies described may not be suitable for all investors. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. The Bloomberg Barclays Aggregate Bond Index is an index used by bond traders, mutual funds, and ETFs as a benchmark to measure their relative performance. The index is broadly considered to be the best total market bond index, as it is used by more than 90% of investors in the United States.

Price to forward earnings is a measure of the price-to-earnings ratio (P/E) using forecasted earnings.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.