Q2 2025 Update: Investments – Remaining Disciplined

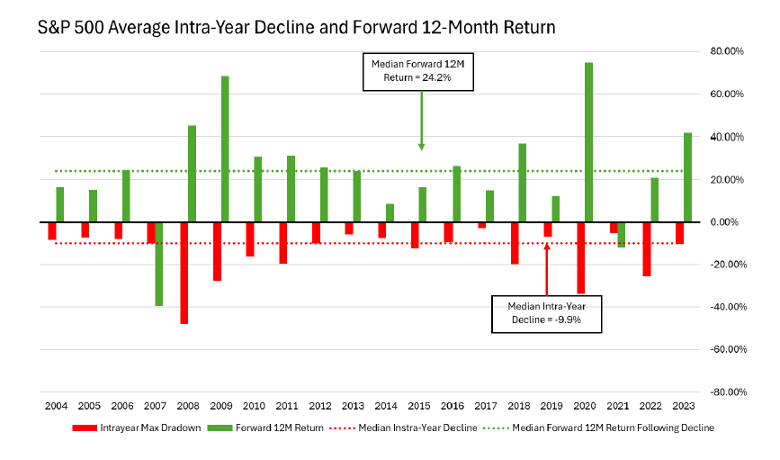

Market volatility is a natural part of investing (see chart below). While the pace of the recent changes can feel overwhelming, especially considering daily tariff headlines and the 24-hour news cycle, it is important to keep a broader perspective and maintain discipline.

Source: Bloomberg 10/15/2024

As of April 14th, the S&P 500 is down roughly 8% year-to-date. Yet, through several significant challenges of the past five years, it has still delivered an impressive 14.2% annualized return (Source: Bloomberg, February 28, 2020 through April 14, 2025). Importantly, this five-year period includes the major sell-off in the early days of COVID in 2020 and the rapidly rising interest rate pressures of 2022 which saw a -18% annual loss for the index.

As we highlighted in our recent message on March 12th “Staying Focused Amid Market Volatility,” staying disciplined and avoiding panic during these turbulent times is crucial for long-term investors. History shows us that missing just a few “good” market days can significantly impact overall returns—like the 10% single-day rise seen on April 9. (Refer to the referenced chart illustrated in the message.)

How is the U.S. Economy? The U.S. economy started 2025 on solid ground with easing inflation and a robust labor market. However, despite the strong foundation, increased economic uncertainty will likely have a negative impact on growth. The actual impact will depend on the outcome of any tariff negotiations, as well as business and consumer actions or inactions as a result. The estimated impact from the announced tariffs equates to a roughly -1% reduction on U.S. GDP in 2025 (Source: Yale Budget Lab, April 2, 2025). While this does not necessarily indicate a recession, it is a more challenging economic backdrop with potential for a range of outcomes: the very definition of uncertainty.

What Does This Mean for Investing? Our investment team remains steadfastly disciplined by adhering to Acumen’s long-term investment and risk management philosophy. As a refresher, key components of our investment strategy include:

1. Appropriate asset allocation to equity, fixed income, and alternative investments based on each client’s unique situation.

2. A quality-focused investment selection within our Acumen equity model which has historically exhibited lower volatility relative to our equity benchmark.

3. Attempt to capitalize on attractive investment opportunities as they arise.

We believe with these three tenants in mind, this is an ideal time to maintain an active quality approach in Core Equity to weather the market volatility. It is also an ideal time to make some adjustments in Opportunistic holdings. These adjustments are a portion of the equity portfolio allowing for more tactical adjustments around the “edges.” Tactical opportunities tend to be more interesting in volatile markets like these. For instance, on April 4, we identified an opportunity to simplify our Opportunistic holdings by swapping more complex equity positions for a passive investment in the broader U.S. stock market at a more favorable valuation. We will continue to make tactical adjustments where opportunity arises.

We remain disciplined during times of uncertainty and appreciate your trust in us.

Acumen weighted equity benchmark is 75% Russell 3000 (IWV) ETF and 25% All-Country World Index Ex US (ACWX) ETF.

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. The information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involve risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.