Q3 2023 Market Commentary

Overview

- The Macro landscape points to a transition in the business cycle from a Slowdown phase to a Contraction phase.

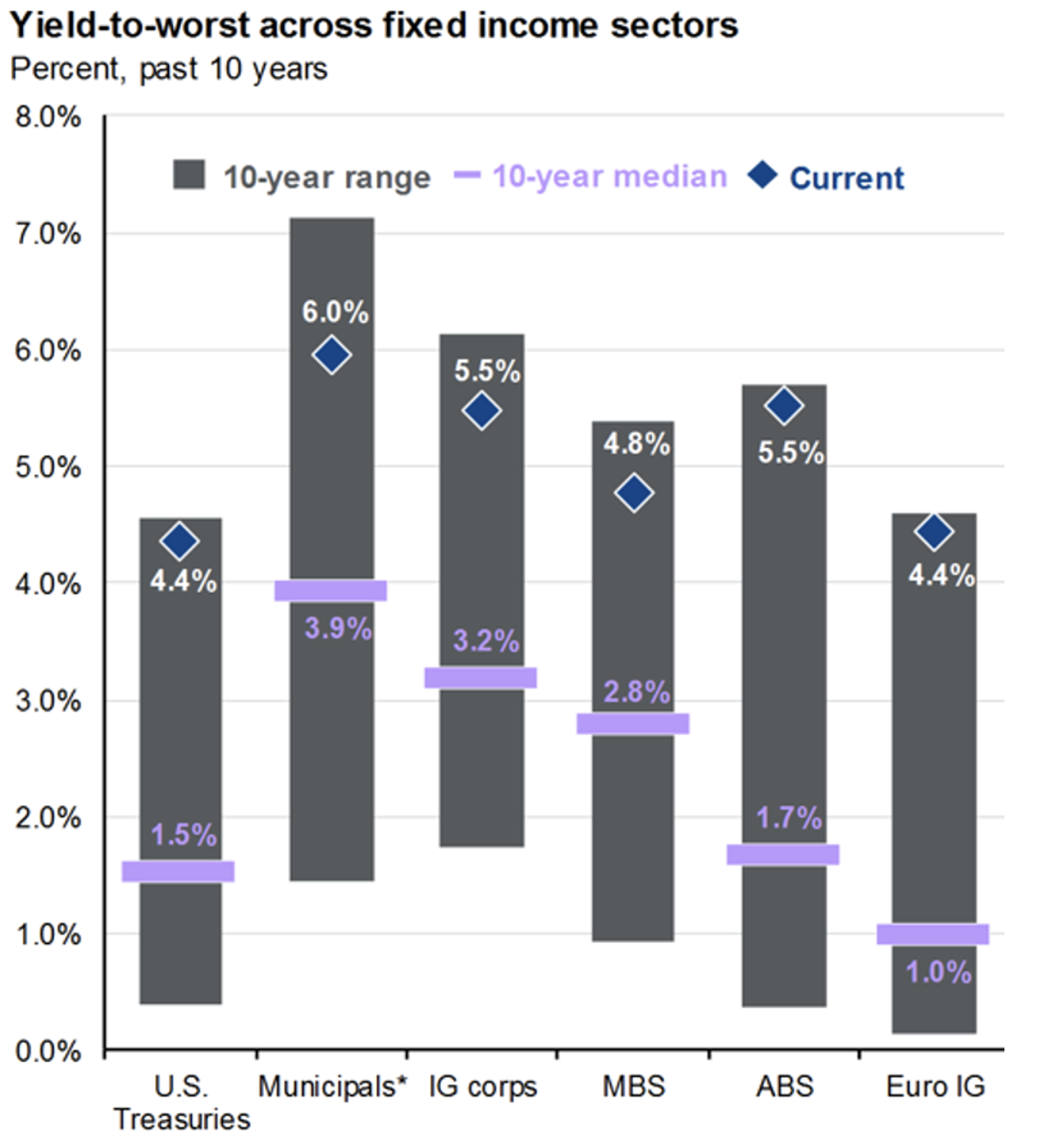

- Bonds offer an attractive investment opportunity as yields across the fixed income market are higher than we have seen in recent decades, and any sort of risk-off environment, caused by a recession, should provide tailwinds for higher quality areas of the asset class.

- The stock market has defied most investors’ expectations going into the year, but we find participation has been limited to sectors which performed poorly in 2022 and securities which are direct beneficiaries of Artificial Intelligence (AI).

Macro

Economic growth has slowed as we predicted, and even contracted by some measures, but remains generally resilient. Inflation has cooled substantially, and the labor market has started to weaken. Leading economic indicators continue to point to an economic slowdown, and the treasury yield curve is the most inverted since the 1980’s. For reference, a recession has followed each yield curve inversion using data back to 1961. A few leading indicators rebounded in recent months, such as the stock market and recent housing data.

Historically, monetary policy works with a lag, taking time to slow down the economy. For example, it typically takes roughly two years after the Fed’s first interest rate increase for the labor market to weaken, and it has only been 16 months since the first increase. Leading labor market indicators point to an upcoming slowdown. For example, initial jobless claims have consistently increased during the first half of the year. Corporate profits are declining, sales growth is slowing, and margins are squeezed. Additionally, student loan interest forbearance will come to an end in October, and excess savings pent up during the pandemic are depleted according to economic research by the Federal Reserve. These factors are likely to further weaken corporate profits and place more pressure on the labor market in coming months. While the Fed expects to raise rates more in the second half of 2023, their forecast is to cut rates in 2024. Because of all these factors, we believe we are still in the slowdown phase of the business cycle, transitioning to the contraction phase.

Bonds – As detailed in the past and in the above commentary, the Fed has embarked on one of the most restrictive monetary policy regimes ever seen – causing interest rates and bond yields to rise incredibly fast throughout 2022 and at a slower pace so far in 2023. As a result, bond yields remain around the highest in almost 20 years (shown below). The historically attractive yields on bonds, combined with the possibility of a transition to a contraction in the business cycle, has led us to slightly overweight fixed income assets in client portfolios. While 2022 was a historic anomaly with bonds underperforming right alongside equities, we believe bonds provide more of a ballast to a traditional bond/equity portfolio in the current environment. This belief is viable since interest rates are higher in 2023 and the proportional increase in rates from here is likely fairly low. (Recall, as rates increase, the market value of a bond decreases and vice versa.) The other component of a bond’s yield is spread which indicates the additional yield investors require to take on the risk of loaning to anyone other than the U.S. government. Year to date, spreads remain relatively steady across higher and lower quality corporate issuers, indicating most of the increase in yields is from higher underlying rates and not currently flashing any broader caution signs. Within core bond portfolios, we have selectively lengthened duration to a more neutral range to take advantage of higher yields and lock them in for a longer period of time. We have also continued to add to positions in short-term treasuries which offer attractive yields and provide dry powder in the event we see a buying opportunity in riskier assets at some point during the next 12 months.

Source: JP Morgan; data as of 6.30.2023

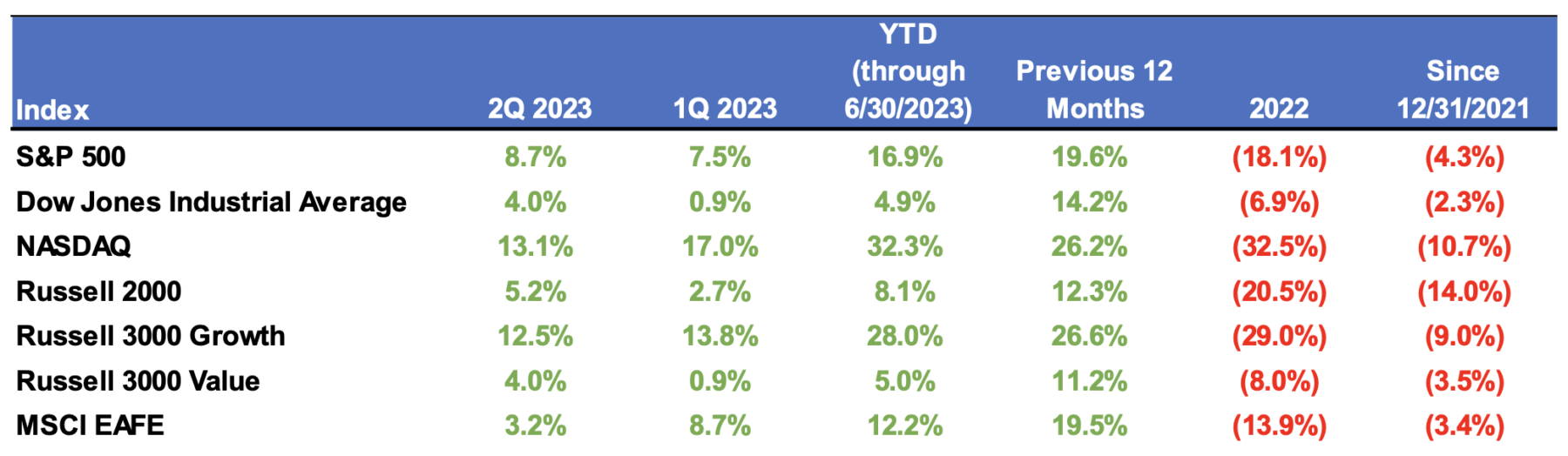

Equities – The S&P 500 is now up more than 16.5% for the year and has defied most investors’ expectations coming into 2023. Now, the index is only down around -4% since its peak on 1/3/2022. One continuation from the trends in 2022 is the large variance in performance across equity styles and sectors. Most notably, interest rate and growth sensitive areas of the equity market outperformed in 1Q and 2Q of this year by a large margin. The NASDAQ is up 32% and the Russell 3000 Growth is up 28%. For comparison, the Russell 3000 Value and the Dow Jones Industrial Average are both up just over 4.5% year to date. We would attribute the difference in performance to a few factors. One, market expectations for interest rates and inflation have both moved lower. Growth and interest rate sensitive areas of the stock market typically outperform during this type of environment. Two, we find there to be a large revaluation effect taking place within areas of the stock market which will be direct beneficiaries of the Artificial Intelligence revolution. Lastly, investors have likely rebalanced portfolios because of the performance difference in 2022.

Source: Bloomberg as of 6/30/2023

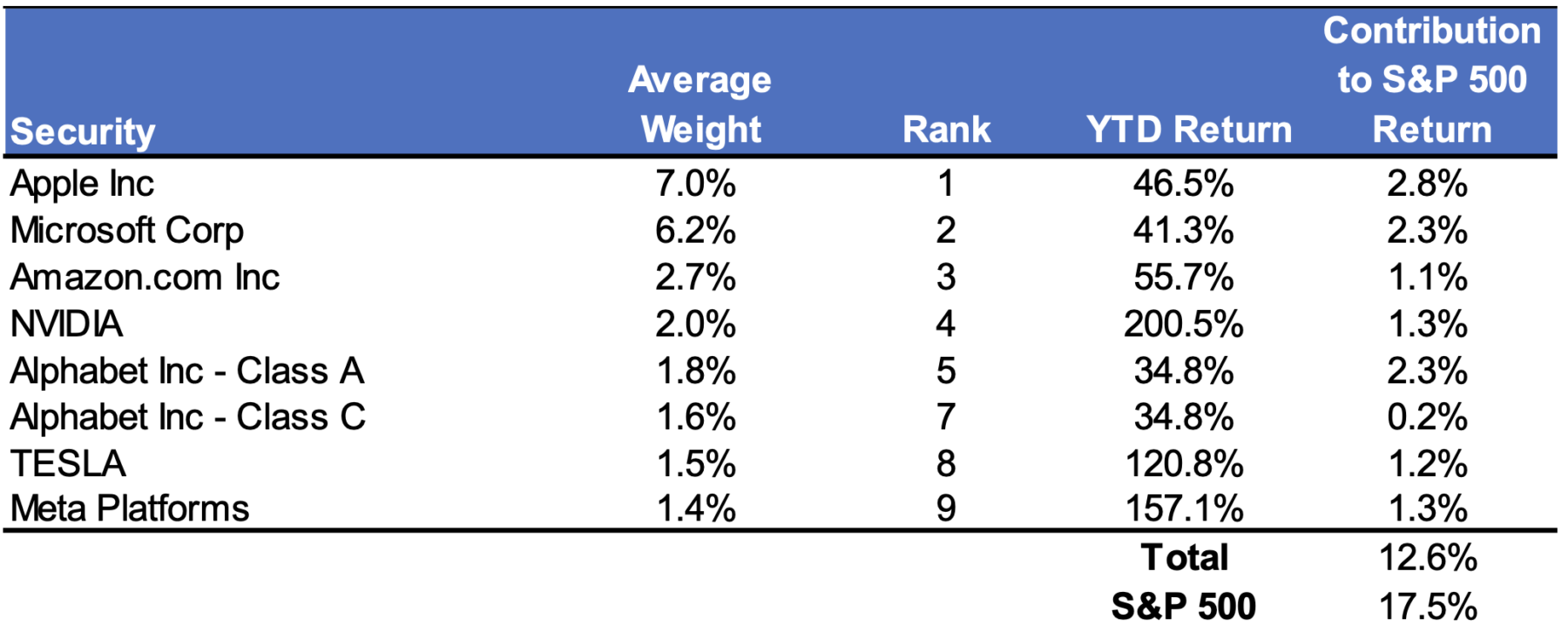

Sector and industry performance was also bifurcated during the first half of the year. For instance, communication services, information technology, and consumer discretionary are all up more than 30% year to date. The best performing sectors from 2022 (energy, health care, and utilities) are the worst performing to start 2023. Again, we think potential for the adoption of Artificial Intelligence contributed to the variance in sector performance. The majority of the contribution to equity market returns year to date has been driven by a concentration of stocks which are direct AI beneficiaries. In fact, eight of the top ten market cap stocks in the S&P 500 have contributed to 12.6% of the index’s 17.4%, or around 73%, of the total return. This is what we would typically refer to as “low market breadth”. In other words, the broad stock market hasn’t participated in the same sort of upside as a few stocks.

Source: Bloomberg as of 7/13/2023

We believe these specific factors are incredibly important. If we go back to our market commentary heading into 2023, we weren’t entirely optimistic about stocks for the coming year, and portfolios have mirrored that viewpoint through a moderately risk-off approach. It can often be easy to allow strong momentum in headline indexes to shift the narrative. However, we believe the fundamentals continue to support a defensive tilt in portfolios today. Our conservative approach to equities has been represented through a slight underweight to the asset class, but most importantly through active management of stock exposure leading to an overweight of some of the major outperformers mentioned above. Additionally, the concentration of performance to select styles, sectors, and securities validates this viewpoint to a certain extent. We also note it is incredibly important for investors to have a game plan. Specific factors, which would cause us to shift from this conservative mindset, would be a resilient labor market in the midst of slowing inflation, a shift in monetary policy, and broader participation in the stock market. As mentioned above, we have used our defensive approach to tilt into short-term treasuries which can provide dry powder in the case of an attractive buying opportunity. Lastly, because of the wide variance in performance across equity market styles, we believe there could be opportunities in underappreciated areas of the stock market sooner rather than later.

Alternatives – We continue to believe alternative investments across different spaces offer attractive return and diversification opportunities to certain investors. These opportunities exist across private credit, private equity, and private real estate in specific geographies.

Closing Remarks

We stay patiently cautious within client portfolios, while seeking opportunity in areas where there is the most attractive risk/reward profile. We think the underlying economic fundamentals point to the slowdown phase of the business cycle, moving towards contraction. Because of this, fixed income is favored, given higher starting yields. While we have been pleasantly surprised by the performance in the equity market year to date, the risk/reward profile for the asset class leaves us cautious. With that being said, we are always looking for opportunities in underappreciated areas within the stock market, which could be apparent sooner rather than later.

Thank you for working with our team. Please reach out if you have any questions.

Best,

Your Acumen Team

Information used in this commentary was obtained via Bloomberg L.P.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.