Q3 Market Commentary

Economic activity remained positive in the second quarter of 2024. Inflation measures declined from April to June, after remaining surprisingly persistent in the first quarter. The Federal Reserve’s preferred inflation measure, Supercore PCE1, rose from 3.34% on a year-over-year basis in December 2023 to 3.52% in March 2024.

Initially, the market expected approximately six rate cuts for 2024. However, due to persistent inflation, these expectations were revised, recognizing the need for prolonged restrictive monetary policy. The recent slowdown in inflation is welcomed with market participants now anticipating two to three cuts to the Fed’s benchmark rate by year end.

Our team believes expectations for the Federal Reserve to ease monetary policy may have led to stronger than expected economic growth and inflation in the first quarter. If consumers and businesses expected significant rate cuts, they likely believed in sustained economic expansion, prompting increased spending and investment. This optimism could have contributed to the sticky inflation observed earlier in the year.

A strong labor market has also contributed to inflation persistence although it has shown signs of cooling. The unemployment rate has risen from 3.7% at the start of the year to 4.1% today, but weekly jobless claims remain steady. The civilian labor force grew by nearly 560,000 people since January with the number of unemployed increasing by 540,000. These numbers suggest the rise in unemployment is due more to new workforce entrants than layoffs. Labor market flows confirm this showing minimal movement from employed to unemployed statuses.

Federal Reserve Chair Powell believes the labor market is now back into balance. 2 Despite this, the Fed has not yet implemented rate cuts, maintaining inflation must approach their 2% target or the labor market must weaken significantly. These dynamics have kept the U.S. Treasury yield curve inverted with short-term interest rates higher than long-term rates. Investors have benefited from this by investing in short-term treasuries yielding over 5% on average in the past year. While cash typically does not outperform the broad bond market, recently, it has. We still find the broad bond market attractive with yields higher than they have been in 15 years. We expect short-term rates to decrease with future Fed cuts.

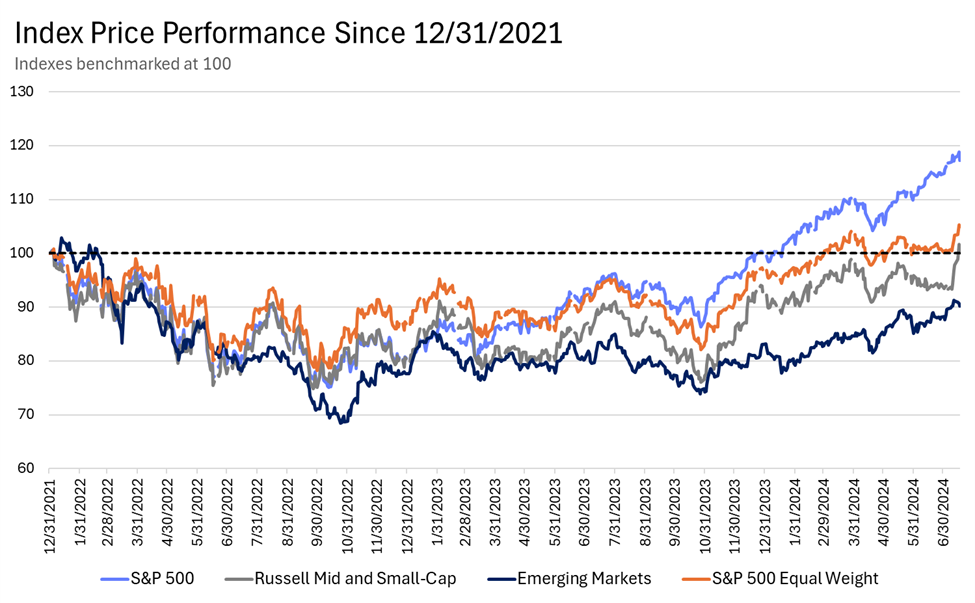

An inverted yield curve has typically signaled a contraction in the credit cycle which caused many investors to underweight stocks going into 2024. However, the S&P 500 has continued to reach new all-time highs. Most gains have come from a small number of companies, leading to extreme market concentration. Today, the top ten companies in the market cap-weighted S&P 500 constitute about 36% of the index. According to Strategas, these companies also represent around 30% of the net income for the index, suggesting some concentration is justified. However, we see significant investment opportunities beyond these top companies. The equal-weighted S&P 500 has lagged behind the market cap-weighted index by 8.5% this year, indicating potential in other areas.

We have recently increased exposure to small- and mid-cap stocks and emerging markets. These sectors have not matched the performance of large-cap domestic stocks but have multiple catalysts for growth over the next few years. Small- and mid-cap stocks, as well as emerging markets, are valued below their historical levels and the domestic stock market. They also have more normalized earnings growth expectations. We believe these areas present significant opportunities for active management as opposed to passive investments.

The macro environment remains mixed with areas of cooling activity balanced by high liquidity. We see the greatest risks in market concentration and are managing client portfolios accordingly. We are underweight exposure in highly concentrated names relative to passive indexes and finding opportunities in underperforming areas with unique macro tailwinds. Additionally, we continue to see value in the broad bond market after its poor post-COVID performance.

Sources

Information used in this commentary was obtained via Bloomberg L.P.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. The views and strategies described may not be suitable for all investors. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

This communication may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.

Supercore PCE refers to a specific subset of the Personal Consumption Expenditures (PCE) price index that focuses on core services, excluding housing and energy services.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place..