Q4 2025 Market Insights

The S&P 500 index rose 14.81% in the first three quarters of the year. From the low point on April 8th, the index was up 34.2% at the end of the third quarter with minimal declines during the recovery. Bond returns were positive in the quarter as rates fell in part due to the Fed decision to lower rates 0.25% on September 17th.

An important development in the third quarter is that U.S. economic growth likely accelerated, which defied expectations of a deceleration coming into 2025 due to tariff pressure, immigration policy limiting the labor supply, and higher interest rates. Inflation has remained above the Fed’s target, but low enough when combined with a soft labor market for the Fed to resume their cutting cycle. The labor market has weakened, but in a controlled manner. We view the labor market as balanced, and consumer spending remains solid.

In our view the biggest risk to the market is expectations are very high. If earnings in the third quarter are “good” but not “great”, there is likely to be a correction in U.S. stocks. Importantly though, we are likely to view pullbacks as buying opportunities since we believe the AI theme is secular (not cyclical) and related tailwinds are growing. We also believe the administration’s policy will be very supportive if there is a major correction. As inflation continues to gradually ease, our “base case” is the Fed can deliver a few more rate cuts going into 2026, economic growth avoids a deep slump, and stocks continue to grind higher, albeit with pockets of increased volatility.

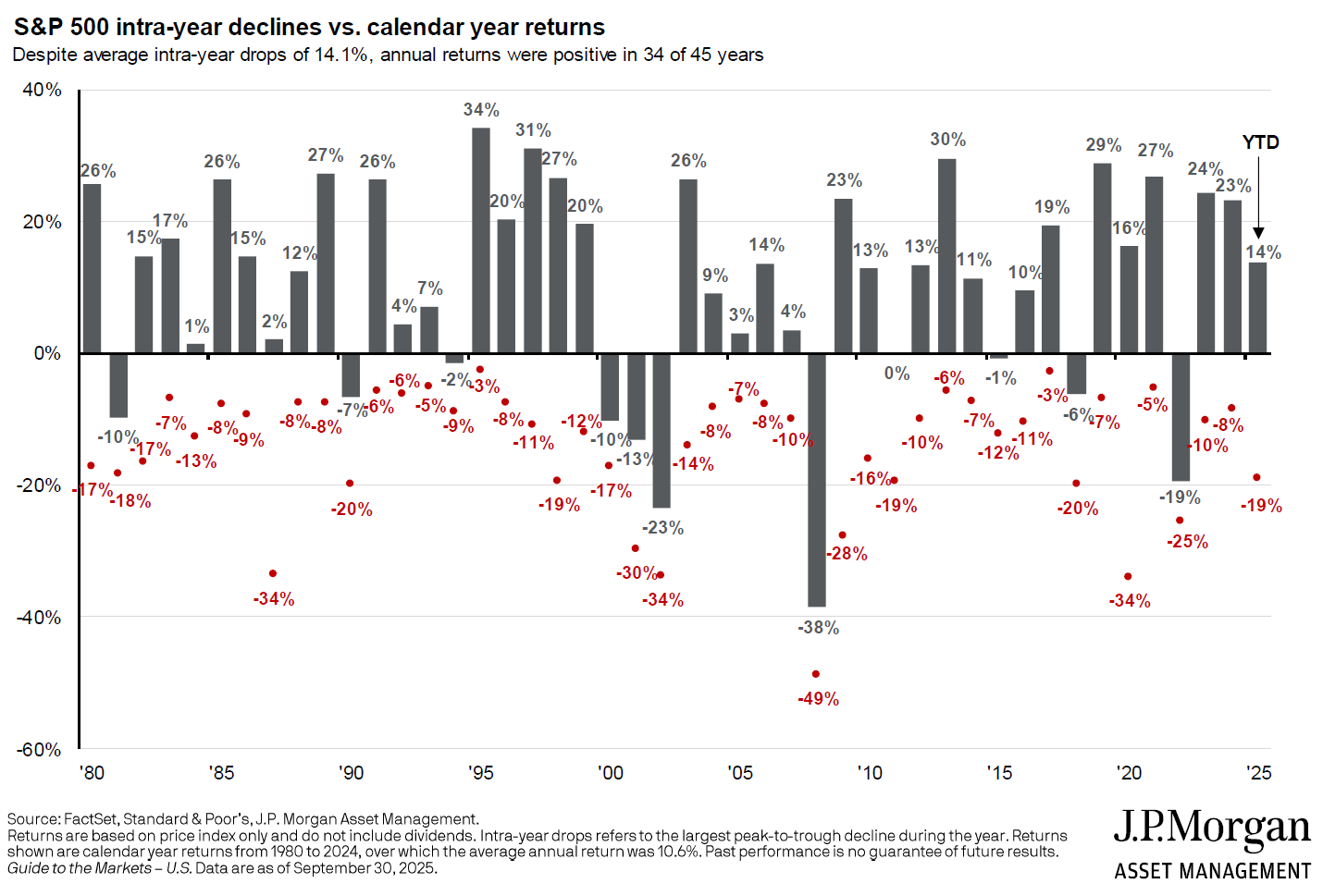

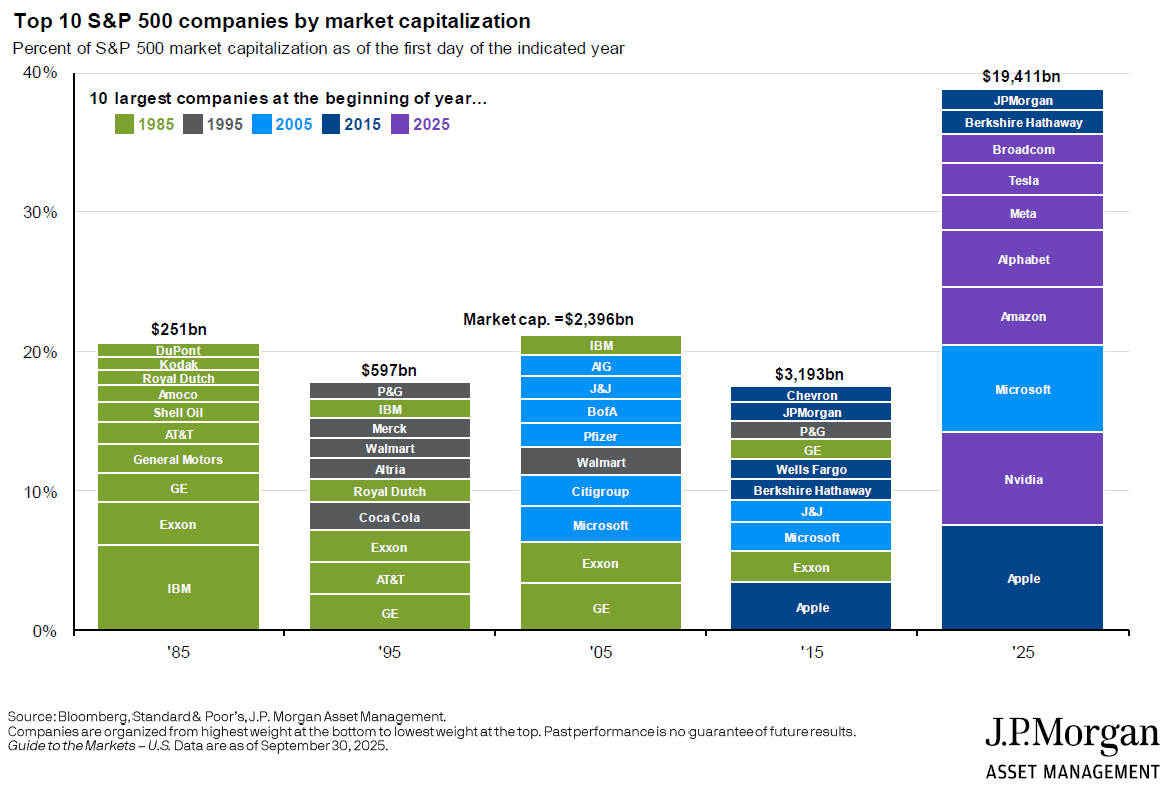

We would like to share two visuals to support investing principles and highlight a key theme of today’s market below. The first chart shows that stock market volatility is normal. The average intra-year decline is ~14%, but calendar year returns are generally positive. 2025 has been a textbook example of this so far. The second chart shows the largest ten names in the S&P 500 index during various time periods. We believe this chart is important for multiple reasons. 1) The ten largest companies today make up a larger share of the index than the past, 2) The composition of the largest names tends to change over time.

We thank all our clients for trusting us to navigate these markets. It is hard to believe it is the last quarter of the year. We look forward to assisting you in navigating these markets this quarter and in the years ahead.

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. The information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involve risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

Acumen Wealth Advisors®, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors®, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors®, LLC unless a client service agreement is in place.