The Rising Cost of Insurance

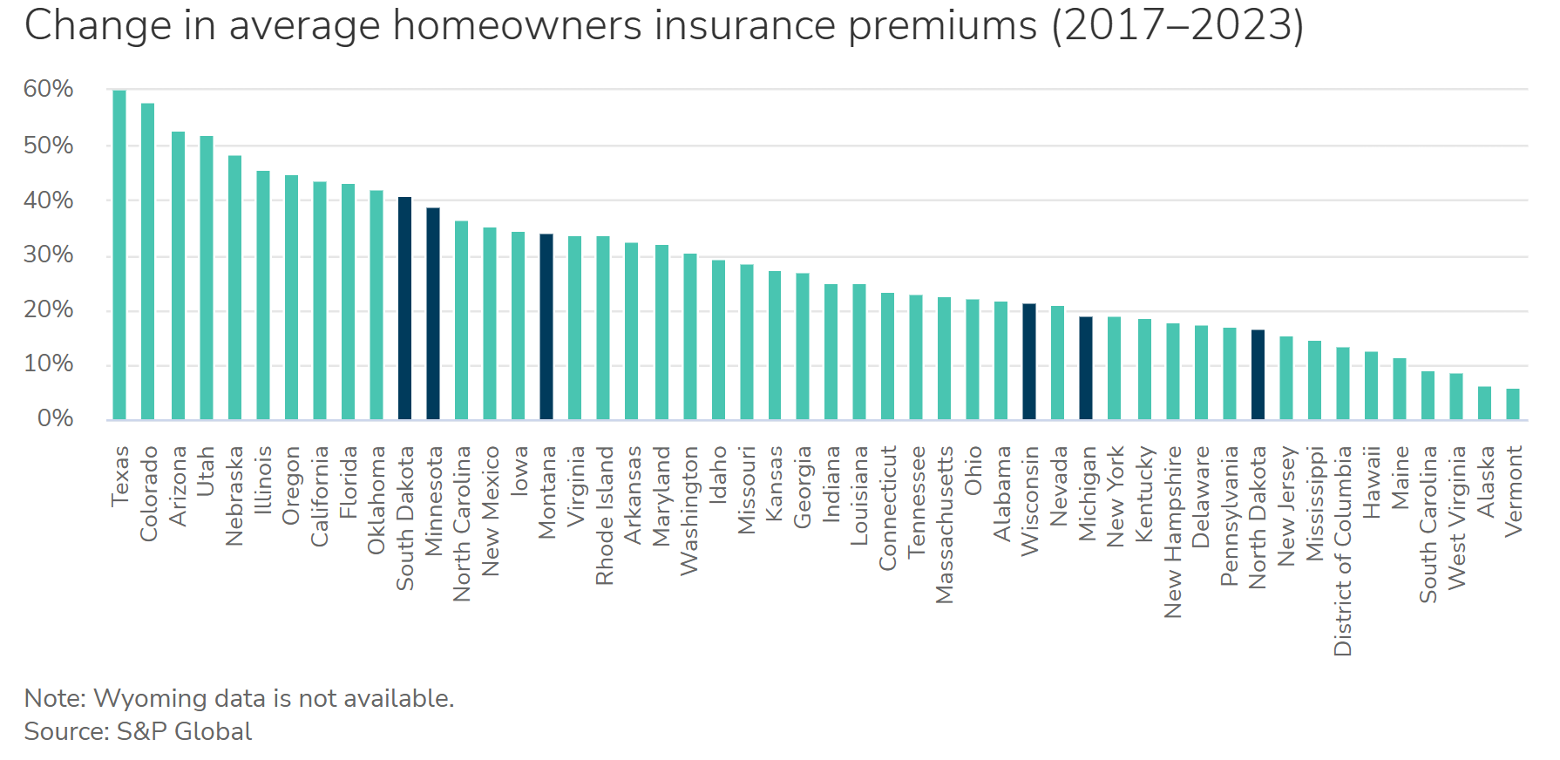

Homeowners insurance rates rose dramatically between 2023 and 2024. These rate changes are based on a Bankrate analysis of data from Quadrant Information Services. The average premium in February 2024 was approximately $141 a month for a home worth $250,000 of dwelling insurance. This premium is a 23% increase from January 2023.[1]

Other studies show this is not a new issue. Average homeowners’ insurance premiums per policy increased 8.7% faster than the rate of inflation from 2018 to 2022, according to the data analyzed. Some consumers faced substantially larger premium increases than the national average.[2] According to the National Association of Realtors, the average insurance cost is $2,377 annually and expected to increase. This increase is added to a 20% increase over the two prior years. Also, some coastal areas and inland locales could see a double-digit percentage rise this year, according to Insurify’s 2024 Insuring the American Homeowner report. States like Florida, Louisiana, and Oklahoma are expected to see the highest annual spikes in the country. The report further warns weather forecasters are predicting a lively hurricane season which may lead to additional rate increases into 2025 in many coastal areas. Large insurers, such as State Farm, Allstate, and Farmers, are exiting states like California and Florida that are perceived as high risk. In addition, more than a dozen home insurance companies have declared insolvency since 2019.[3]

Factors Impacting Homeowners Insurance Increases

- Location – Living in a region prone to natural disasters can lead to increased premiums due to increased likelihood of a claim. Damage from wildfires, tornadoes, hurricanes, and floods cost more each year, causing some insurance companies to limit their coverage in high-risk areas or raise rates.

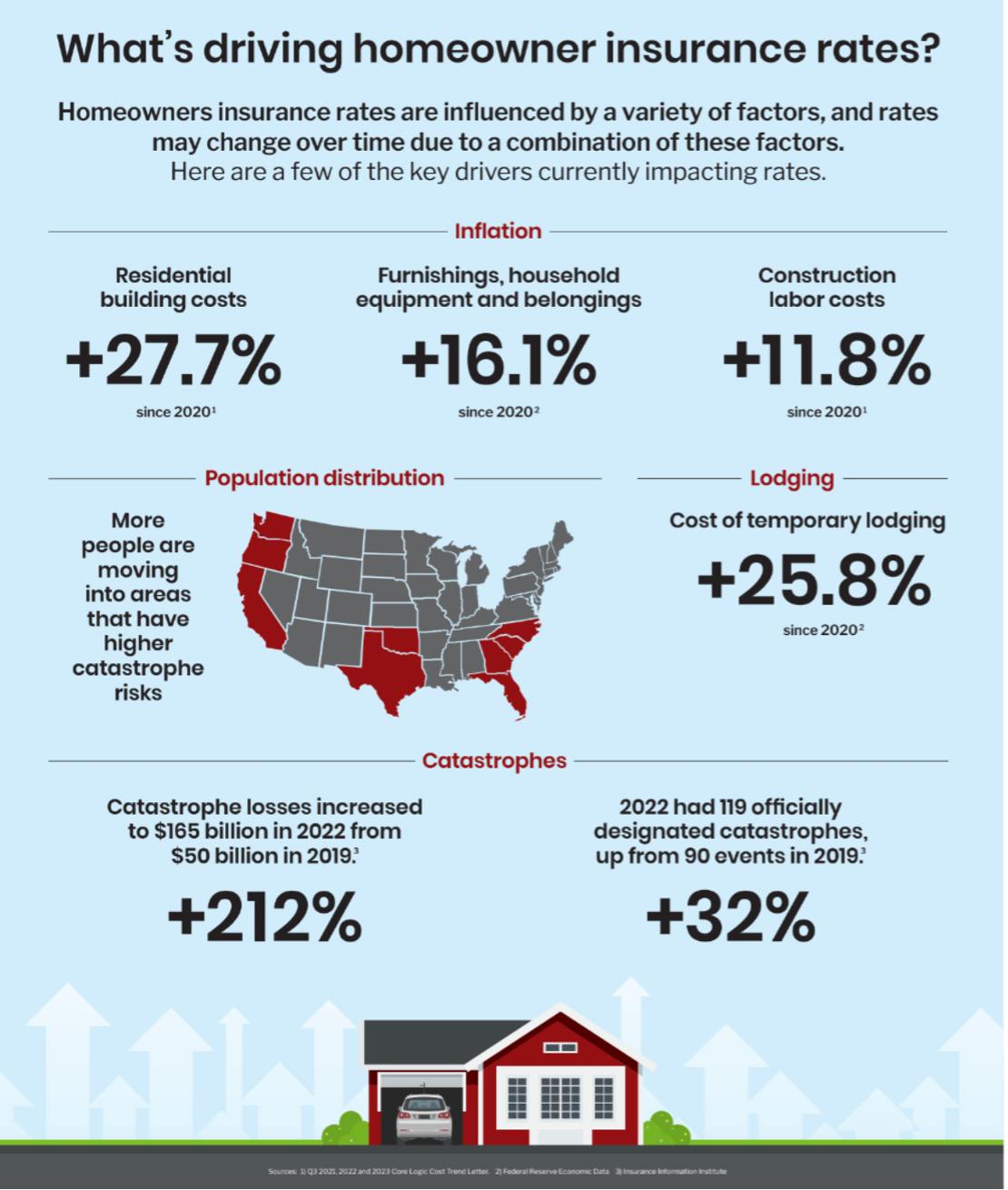

- Inflation – While inflation has slowed since its peak, insurance rates are reactionary. The cost of insurance is still increasing due to the impact inflation has had on the previous losses experienced by insurance companies. With higher inflation, an elevated cost of building materials is a result. Since 2020, residential building costs have risen almost 28%. This rise includes the cost of maintenance for homes and the cost of repairs or rebuilds in the event of a disaster.

- Higher Labor Cost – An analysis by Mercury Insurance found labor costs jumped nearly 12% since 2020.

- Insurers Rates Increasing – Because catastrophes can cause severe damage across a large area, the result may be severe losses to insurance companies. To reduce their risks, insurers also buy insurance called “reinsurance.” But reinsurers also face financial stress from catastrophes not just in the U.S. but worldwide. The increase in reinsurance costs for insurers is a direct consequence. In the past several years, an index measuring reinsurance costs for property insurers, which includes homeowners’ insurance providers, has increased by double digits. This increase includes 15% in 2022 and 35% in 2023 according to reinsurance brokerage Guy Carpenter. (4)

Chart Source : https://www.mercuryinsurance.com/resources/home/whats-driving-homeowners-insurance-rate-increases.html

Chart Source: https://www.minneapolisfed.org/article/2024/homeowners-insurance-costs-are-growing-fast-but-coverage-is-shrinking

Steps To Help Lower Your Premiums

- Maintain a High Credit Score – On average, homeowners with poor credit histories pay 77% more for home insurance than homeowners with excellent credit.(5)

- Consider Higher Deductibles – While not ideal, consider the threshold of making a claim. There are implications to making a claim, particularly if multiple properties are insured. Some carriers end coverage after two claims. With healthy cash reserves, higher deductibles may be beneficial to utilize insurance for catastrophic use.

- Shop and Bundle – Carriers generally give the best discount to consumers who have all insurance bundled. Given the rapid increases in homeowners’ insurance, the insurance policy should be reviewed annually to ensure maintenance of ideal replacement coverage. Also, obtain quotes from other carriers.

- Home Improvements – Consider upgrades, particularly storm- and fire-resistant improvements, such as a metal roof, updating electrical systems, storm-resistant windows and shingles, indoor sprinkler system, and maintaining landscaping to cutting trees at risk of falling and adding better drainage.

This report is provided as a courtesy for informational purposes only. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

(4) Source: https://www.minneapolisfed.org/article/2024/homeowners-insurance-costs-are-growing-fast-but-coverage-is-shrinking#:~:text=But%20reinsurers%20have%20also%20faced,to%20reinsurance%20brokerage%20Guy%20Carpenter

[1] Source: https://www.cnbc.com/select/homeowners-insurance-skyrocketing-how-to-lower-premium/#:~:text=Homeowners%20insurance%20rates%20rose%20dramatically,23%25%20increase%20from%20January%202023

[2] Source: https://home.treasury.gov/news/press-releases/jy2791

[3] Source: https://www.nar.realtor/magazine/real-estate-news/states-where-home-insurance-costs-are-surging-highest