U.S. Budget Concerns

The federal budget has resurfaced as a significant concern. Tax cuts and economic stimulus during Donald Trump’s presidency, coupled with substantial spending by President Joe Biden, have widened the disparity between revenue generated and funds allocated. Interest rates have risen in the past two years, making it more costly to manage additional debt. Forecasts indicate substantial spending in the years ahead. Ongoing disputes over spending matters in Washington have begun to unsettle financial markets, raising concerns about the U.S. deficit.

What is the Federal Deficit?

- A federal deficit occurs when the government’s expenditures exceed its revenues.

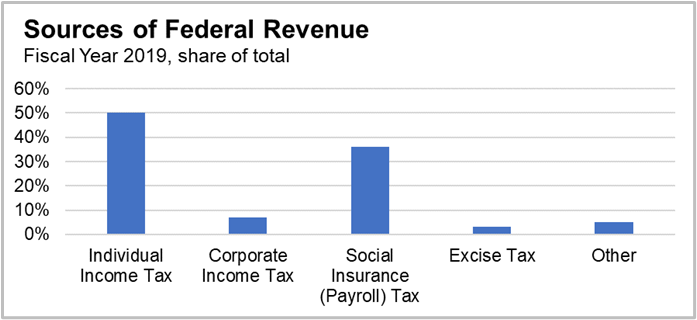

- Revenues include Individual Income Taxes, Corporate Income Taxes, Social Insurance Taxes, Excise Taxes, Custom Duties, Estate and Gift Taxes, Miscellaneous Receipts (fees, fines, and other tax revenues), and Interest Income. The primary source of revenue for the U.S. government is various taxation methods. (See Figure 1.)

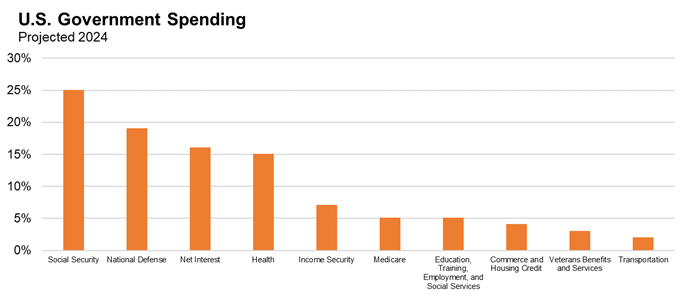

- U.S. government spending encompasses various items, with the projected top four expenditures in 2024 being Social Security, National Defense, Net Interest (interest paid on debt minus interest earned), and Healthcare. Notably, Net Interest is expected to be the third largest expense in 2024, trailing Defense by approximately 3%. (See Figure 2.)

- In 2023, the federal deficit reached $1.7 trillion, an increase from $1.38 trillion in 2022. Such a substantial fiscal deficit is unusual during periods of robust economic growth, causing concern among many. Deficits of this magnitude are typically associated with wartime periods. Some argue the Covid pandemic justified such fiscal deficits.

- Many observers assess the federal deficit as a percentage of the Gross Domestic Product (GDP). In 2023, the deficit as a percentage of GDP was 6.3%, a level not seen in the six decades preceding the 2008 financial crisis.

What is the Problem with Federal Deficits?

- During a period when interest rates hovered close to 0%, and the Federal Reserve stood as one of the largest purchasers of U.S.-issued debt, unlike today, deficits weren’t a central concern.

- As interest rates have risen and the government has continued to spend more money, there is concern the financial burden may surpass the large demand investors have traditionally had for U.S. treasuries. This shift in demand is already evident in recent treasury auctions as well as foreign demand for falling treasuries.

- In the past, significant spending increases have prompted the emergence of “bond vigilantes”. This group of investors is acutely aware of fiscal and monetary policies, and they attempt to impose discipline on governments by selling bonds in response to policies they believe are fiscally irresponsible or possibly inflationary. The idea is the selling pressure on bonds would lead to higher interest rates, which can act as a form of market discipline.

- This “bond vigilante” group is widely believed to be made up largely by banks and insurance companies, as they are negatively impacted when rates rise quickly from an increase in borrowing. We specifically saw this situation in early March with the downfall of Silicon Valley Bank. When the government borrows more, it usually leads to an increase in the supply of government bonds. Basic economic principles suggest an increase in the supply of bonds can put downward pressure on bond prices, which equals an upward pressure on yields. As bond prices fall and yields rise, this situation can lead to losses for investors holding bonds with lower interest rates. This environment is especially harmful for the large bond portfolios at banks and insurance companies. Another factor is the general increase in credit risk concerns. Higher interest rates may crowd out private borrowing, making it more expensive for businesses to borrow, potentially leading to concerns about credit risk.

- These larger investors may then demand a higher yield for treasury debt which can then squeeze the cost of borrowing even higher.

Why are We Here Now?

- Federal deficits are common for the U.S. The U.S. has only recorded an annual surplus (the opposite of a deficit) six times since 1960. The last was in 2001. However, this deficit hasn’t been a huge deal in the past, as there has been a growing popularity in what many refer to as Modern Monetary Theory – essentially claiming the U.S. should spend as much as they want if inflation doesn’t become an issue. We all know how well this has worked as of late.

- The recent surge in deglobalization and our country’s aging population could both turn out to be longer term inflationary factors. Consequently, government debt will likely be in greater focus. Academic circles and economists often refer to the aging demographic as a deflationary force, but also causes the government to pay out more in Social Security pension payments and Medicare health benefits.

- The financial crisis in 2008 and the Covid pandemic exacerbated budget issues. The global financial meltdown of 2008 triggered a severe economic contraction and led to four years of trillion-dollar deficits. Then, in 2020, the pandemic prompted the government to give money to households and businesses to keep the economy afloat. Trump’s $1.5 trillion tax cut in 2017, enacted without offsetting spending cuts, also widened the deficit. In addition, major domestic legislation, signed by Biden, included hundreds of billions of dollars to fund clean energy projects.

Solutions, Fallout, and Portfolio Implications

As far as solutions to the federal deficit, the two primary avenues would be, 1) an economic boom boosting tax revenues while the government tries to curb future spending, or 2) easing gridlock in Washington. Democrats generally oppose cutting safety-net spending programs and while Republicans have largely opposed tax increases. We have already seen some fallout from the recent focus on the nation’s deficit. As mentioned, demand for U.S. treasuries has weakened, and the interest on U.S. debt has largely risen to a point where it is exacerbating the deficit issues itself. If we see a solution, it could possibly come from less future government spending, which would likely bring down expectations for economic growth. One area of focus for portfolio positioning specifically has been taking advantage of the higher yields across the fixed income landscape, which has been aided by this increase in the cost of debt for the U.S.

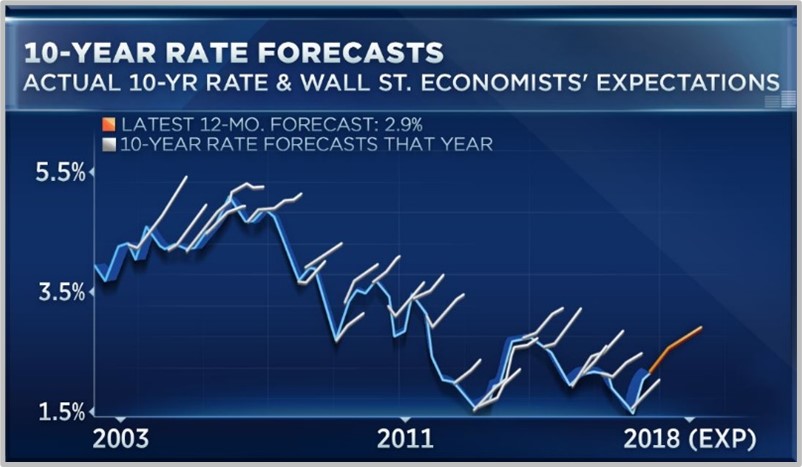

We are reminded interest rates are a “random walk”, and very smart economists have been very wrong about the future path of rates for a long period of time. (See Figure 3.) One factor which is likely to play out, however, is interest rate volatility will likely remain elevated for some time. We believe investors should be prepared to take advantage of this volatility.

Sources:

- Figure 1 – Sources of Federal Revenue. https://www.taxpolicycenter.org/briefing-book/what-are-sources-revenue-federal-government

- Figure 2 – U.S. Government Spending by Category. https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

- Figure 3 – 10-Year Rate Forecasts from Wall St. Economists. https://www.cnbc.com/2017/06/26/wall-street-economists-consistently-wrong-in-10-year-rate-forecasts.html

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness.

This communication may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “should,” “planned,” “potential,” “outlook,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors any or all of which could cause actual results to differ materially from projected results.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.