Comment on January 30th Gold and Silver Drop

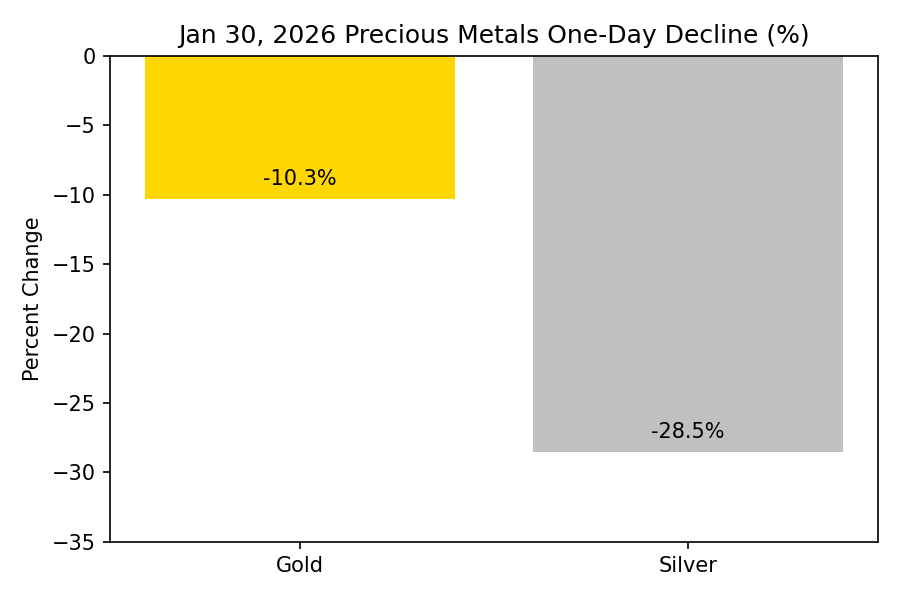

We wanted to provide a quick update on the sharp drop in gold and silver prices on Friday, January 30th. Gold fell about 10% and silver nearly 30% in a single day, marking their worst one-day declines in more than 20 years.

The key point is this: the decline was driven by market mechanics, not a change in long‑term fundamentals. Prices had risen extremely quickly in January, and when markets get that stretched, even a small shift can trigger fast profit‑taking and forced selling. That’s what happened here. Additionally, some other issues helped to exacerbate the sell-off including very thin trading conditions, a heavy use of leverage by many traders, and a sudden jump in the value of the US Dollar.

Importantly, the big drivers that have been pushing precious metals higher, such as central‑bank buying, ongoing inflation concerns, global uncertainty, and strong industrial demand for silver, are all still in place. Nothing fundamental has changed.

For long‑term investors, this looks like a normal correction after a big run‑up, not the start of a new downtrend. Volatility may remain elevated for a bit, but the broader outlook for metals hasn’t deteriorated.

Finally, as a supplement, there was a flash crash in China’s precious metals market overnight. China’s metals market suffered an extreme intraday collapse as Shanghai gold futures plunged over 15%, with silver hitting limit down and platinum/palladium dropping 15–16%, reflecting a structural liquidity shock rather than fundamentals. The China crash was amplified by excessive retail leverage and China’s highly speculative trading environment creating conditions for violent margin spirals once prices broke. This move appears to indicate more of a mechanical deleveraging event, not weakening industrial demand or macro conditions.

While we don’t tend to have direct exposure to these types of commodities, there are always temporary ancillary impacts we may feel as the market reacts. However, our approach of buying a diversified portfolio of high-quality best-in-class companies and investing in the long term is, in our opinion, a good way to avoid most of this volatility and compound attractive returns over time.

If you have any questions, please don’t hesitate to reach out.

Warm regards,

Your Acumen Investment Management Team

Services offered through Acumen Wealth Advisors, LLC®, a Registered Investment Adviser. This message and any attachments contain information which may be confidential and/or privileged and is intended for use only by the addressee(s) named on this transmission. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message. If you do not wish to receive marketing emails from this sender, please send an email to reed.walters@acumenwealth.com. Please note that trading instructions through email, fax or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed.

Any opinions expressed in this email should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.