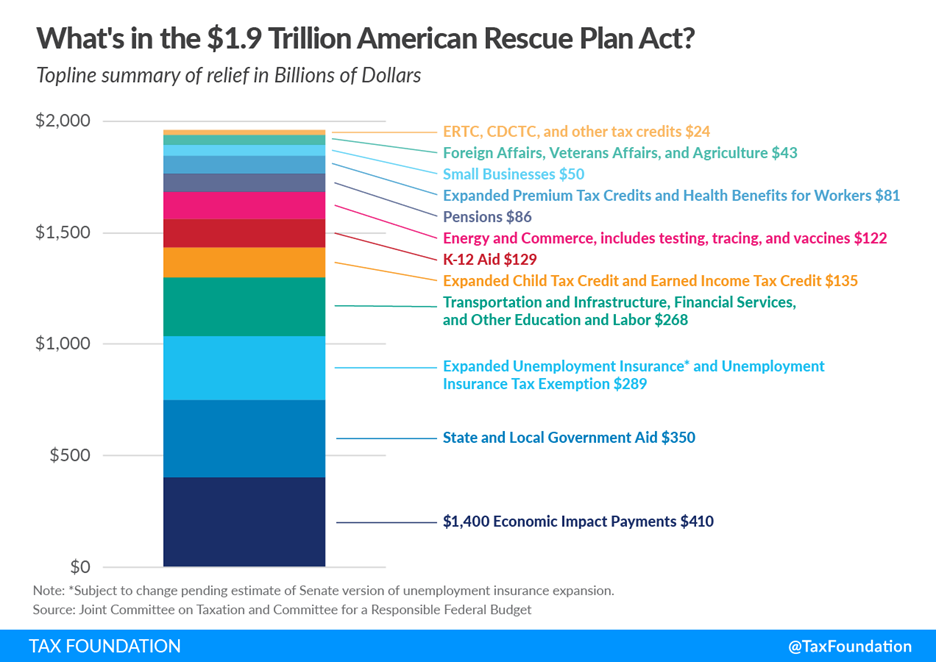

What’s in the $1.9 Trillion American Rescue Plan Act (ARPA)?

The American Rescue Plan Act of 2021 (ARPA) was signed into law on March 11, 2021. This $1.9 trillion stimulus bill aims to provide additional economic relief to taxpayers, businesses, and other employers through various provisions including a third round of direct payments to eligible individuals, an expansion of the Child Tax Credit, additional funding for the Paycheck Protection Program (PPP), and many more. Approximately, $850 billion is directed towards individuals and $65 billion is directed to businesses. Key provisions we find to be relevant for individuals, businesses, and other employers include $1,400 direct payments.

Direct Payments

ARPA provides a third round of stimulus payments up to $1,400 for individuals ($2,800 for taxpayers filing jointly) and qualifying dependents (as defined in Sec. 152). Eligibility for this recovery rebate credit is based on 2020 or 2019 Adjusted Gross Income and the limits are as follows:

| Filing Status | Eligible for Full Payment | Income Phaseout Begins | Not Eligible |

| Single | Less than $75,000 | $75,000 | Greater than $80,000 |

| Married Filing Jointly | Less than $150,000 | $150,000 | Greater than $150,000 |

| Head of Household | Less Than $112,500 | $112,500 | Greater than $112,500 |

Child Tax Credit

For 2021, ARPA expanded the Child Tax Credit amount to $3,600 for children under 6 and $3,000 for children 6 – 17. The standard Child Tax Credit amount and phaseout amounts still apply but this additional tax credit is available to those whose Modified Adjusted Gross Income (MAGI) are as follows:

Standard Child Tax Credit:

| Filing Status | MAGI Threshold | Reductions |

| Single or Head of Household | < $200,000 | This credit is reduced by $50 for each $1,000 of income over these limits. |

| Married Filing Jointly | < $400,000 |

Additional Child Tax Credit through ARPA:

| Filing Status | MAGI Threshold | Reductions |

| Single | $75,000 | This expanded portion of the credit ($1,000/$1,600) is reduced by $50 for every $1,000 of income over these limits. |

| Married Filing Jointly | $150,000 | |

| Head of Household | $112,500 |

This additional credit is fully refundable meaning, if eligible, no tax liability is necessary for the full refund amount. Advanced payments for this 2021 credit will be distributed from July 2021 through December 2021 and will be based on the most recently filed tax return unless eligible individuals opt-out of advance payments through a soon-to-be established IRS online portal.

Earned Income Tax Credit

For 2021, the applicable minimum age is decreased from 25 to, in most cases, age 19. Special conditions apply to students and other youth. The maximum age a childless taxpayer can qualify is eliminated and the maximum EIC amount for childless households increases from $540 to $1,502.

Child and Dependent Care Tax Credit

ARPA increases and expands the Child and Dependent Care Tax Credit from $3,000 for one qualifying individual or $6,000 for more than one qualifying individual to $8,000 for one qualifying individual and $16,000 for more than one individual child. If AGI is less than $125,000, the credit is 50% of the expense amount; this credit phases out completely for AGI over $440,000. This credit essentially means the maximum credit is $4,000 for one qualifying individual and $8,000 for more than one qualifying individual. This credit is fully refundable.

Unemployment Benefits

ARPA increases the total number of weeks benefits are available to individuals who cannot return to work safely from 50 to 79 weeks. Supplemental unemployment payments will remain at $300 per week after March 15, 2021 until September 6, 2021. For those who claimed unemployment benefits in 2020, up to $10,2000 of unemployment benefits can be excluded from income for those with AGIs less than $150,000. For married couples filing jointly who both received unemployment in 2020, each spouse can exclude up to $10,200.

Student Loan Discharge Taxability

Qualifying student loan debt forgiven between December 31, 2020 and January 1, 2026 will not be taxable as income.

Expanded PPP Eligibility and Funding

ARPA provides additional funding for eligible businesses under the Paycheck Protection Program as well as expands eligibility to additional nonprofits and digital news services. Applications are due by May 31, 2021.

Employee Retention Credit and Paid Leave Credit Programs

The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to offset their current payroll tax liabilities by up to $7,000 per employee per quarter. This credit of up to $28,000 per employee for 2021 is available to small businesses who have seen their revenues decline, or even been temporarily shuttered, due to COVID.

The American Rescue Plan also extends the availability of Paid Leave Credits through September 2021 for small and midsize businesses offering paid leave to employees who may take leave due to illness, quarantine, or caregiving. Businesses can take dollar-for-dollar tax credits equal to wages of up to $5,000 if they offer paid leave to employees who are sick or quarantining. More details are provided in IRS Notice 2021-20: https://www.irs.gov/pub/irs-drop/n-21-20.pdf

Targeted Grants

Additional funding for targeted Economic Injury Disaster Loan grants is available for small businesses in low-income communities as well as targeted grants for restaurants, bars, lounges, and food trucks.

Excess Business Loss Limitation

ARPA extends the excess business loss rule (Code Section 461(I)) through 2026 which limits the deduction for excess business losses for noncorporate taxpayers. This provision was enacted under the Tax Cuts and Jobs Act of 2017 and originally was set to end at the end of 2025. Section 461(I) limits up to $250,000 for individual filers and $500,000 for joint filers but the CARES Act removed these limitations for the 2018-2020 tax years.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Sources:

https://www.journalofaccountancy.com/news/2021/mar/tax-components-coronavirus-relief-bill.html

https://www.natlawreview.com/article/american-rescue-plan-act-2021-tax-reports

https://www.jdsupra.com/legalnews/the-most-important-items-in-the-1-9t-4232245/

This report is provided as a courtesy for informational purposes only and nothing herein constitutes investment, legal, accounting, or tax advice. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.