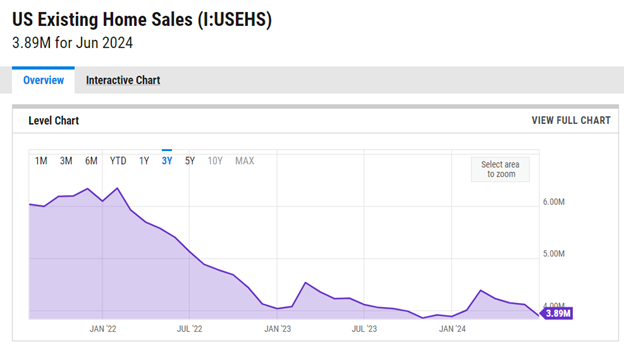

Where Are The Home Sales?

According to National Association of Realtors (NAR), existing home sales fell 5.4% year over year to a current level of 3.9 million. These sales are down from 4.11million transactions a year ago and down from 6.12 million transactions in 2021. The combination of record high home prices and the “locked in” effect of the lowest interest rates in history continues to depress home sales.

Existing homes sales continues to decrease while new homes sales remain relatively constant. Many first time buyers are sidelined due to record high prices and the highest rates seen in recent years. Many new home sales have mortgage rate incentives provided by the builder and this segment effectively becomes more desirable for first time buyers.

Source: https://www.statista.com/statistics/226144/us-existing-home-sales/

Roughly 60% of U.S. homeowners have an outstanding mortgage. Due to the record low rates of 2020 and 2021, many homeowners took advantage of refinancing at historical rates. The following data is a full breakdown of the positions homeowners fall on the mortgage rate spectrum:

- Below 6%: 88.5% of mortgaged U.S. homeowners have a rate below 6%, down from a record 92.8% in the second quarter of 2022.

- Below 5%: 78.7% have a rate below 5%, down from a record 85.6% in the first quarter of 2022.

- Below 4%: 59.4% have a rate below 4%, down from a record 65.3% in the first quarter of 2022.

- Below 3%: 22.6% have a rate below 3%, down from a record 24.6% in the first quarter of 2022.

Source: https://www.redfin.com/news/mortgage-rate-lock-in-housing-2023/

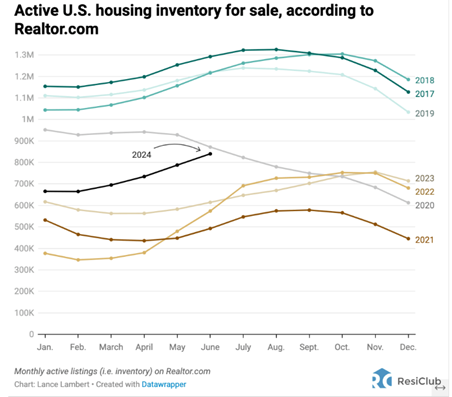

Inventory Increases

The total number of homes on the market has risen throughout the year, ticking up 4% from May to June to stand nearly 23% above last year’s low level. While inventory levels are still about 33% below pre-pandemic averages, it is the smallest deficit since the fall of 2020, when the pool of available homes was quickly dropping.

Inventory is higher than last year in all of the 50 largest U.S. metropolitan areas except two — New York City and Cleveland — and rose month over month in all but five.

Sellers are cutting prices more often to entice buyers. Nearly one-quarter of listings (24.5%) received a price cut in June, the highest rate for this time of year in Zillow records dating back to 2018.

Source: https://ycharts.com/news/story/PRN-SF60917-20240716

Inventory has increased significantly over the past few years, but remains well under 2018 and 2019 monthly active listings. If mortgage rates decrease the remainder of the year, this decline may spur buying and inventory stabilizes or decreases. If rates remain at current levels, we may see this trend line continue.